Starting a new business

Chapter 1: The secret to starting a business

It is a process, not an event, to start a business. People talk about starting a small business as if it were an adrenaline sport. There will be some heart-stopping moments, such as when you take out a loan, sign a lease, or approve your first supply order.

However, starting a business is not a simple decision. Hundreds of little judgments have to be made. And if you want to succeed, you must go through them methodically and with a calm head.

Right now, you don’t have to consider everything.

When you first consider beginning a business, there will be hundreds of variables and several unknowns. It’s difficult to untangle everything.

That is why you require a procedure. It enables you to deal with things in the proper order and prevents you from becoming trapped on issues before you need to.

In eight simple steps, learn how to establish a business.

Step by step, use the tools and ideas in this guide to turn your concept into a business.

- Examine your company concept. Check to see whether your idea has legs.

- Outline your goal and how you’ll get there in a one-page business plan.

- Carry out market research

Learn as much as you can about your consumers and rivals. - Construct a sales prediction. Arrive at a reasonable figure.

- Create a budget

Determine how much money the venture will bring in. - Write a long-form business plan

Make a list of the details (including marketing and promotion). - Organise finance

Calculate how much you’ll need and how you’ll acquire it. - Start-up

It’s time to take the show on the road.

Just figuring out how to start a business is the first step. You’ll need to command the spacecraft once you’ve been launched. There are sales to be made, accounts to be kept, budgets to be kept track of, and taxes to be filed, among other things. This tutorial will walk you through all of that and more.

Make a deadline for yourself to finish your study and preparation. Every week, set aside a specific time to focus on it. You must be disciplined: handle it as if it were a business, and you will reap the benefits.

Chapter 2: Putting small business ideas into action

You don’t have to be a genius to come up with a good business idea. Some of them are extremely straightforward. However, how can you evaluate them and choose the best business concept for you?

How do you come up with a small business idea and determine whether it’s viable? Are you able to conduct your own research? When will you need to enlist the help of professionals? Here’s how to make your company plan a reality.

Where do good business ideas come from?

There aren’t many enterprises that begin with a eureka moment. Some people don’t even begin with an idea. A hobbyist, for example, may find themselves in business simply by doing what they enjoy.

The majority of other firms are based on relatively simple concepts. It could be a reincarnation of an old idea in a new setting. Or an out-of-date service supplied via the internet. To come up with something, you don’t need to be a genius. All you need is the ability to recognise an opportunity.

Brainstorming business ideas

It takes a lot of determination to sit down and come up with a company idea. Most people’s business ideas emerge gradually and in an unexpected manner. However, this should not prevent you from brainstorming.

A brainstorming session today may assist you in coming up with a’spontaneous’ idea later. Many psychologists believe that if you give your brain a task to do, it will continue to do so even if you aren’t paying attention. This phenomenon is known as the Zeigarnik effect, and it may explain why we get ideas when we’re running, showering, or resting in bed, rather than when we’re actively thinking about problems.

So, even if a series of brainstorming sessions yields little in the short term, they may start your mind on the route to a huge idea in the long run.

What products to sell or services to provide?

Many people try to come up with business ideas by first considering items or services.

- What exactly are people purchasing?

For example, there are strategies (and apps) for gauging what’s selling on Amazon. - What are the best-margin products or services?

It’s simple to compare retail prices to delivery expenses for goods or services. - What items or services would be the most expensive to manufacture and sell?

- What products spoil, go out of date, or are difficult to ship will be obvious to you. Likewise, you’ll be aware of which services are likely to become obsolete or impossible to supply effectively.

When writing a formal business strategy, these are excellent questions to ask. When evaluating company concepts, though, don’t overcomplicate it. Begin by identifying a market gap — preferably one that you would like filling. When you’re working on something you’re passionate about, you’ll learn faster and network more effectively.

Bold or traditional company concepts are both viable options.

An novel idea will face different hurdles than a tried-and-true one. On a scale of uniqueness, how original is your idea? Do your personality and skillset lend themselves more to one point of view than the other?

More is involved in new ideas:

- the process of try and error

- suppliers are difficult to come by

- Lenders and investors holding each other’s hands

- educating the consumer

- uncertainty

More is included in tried-and-true statements:

- convention

- politics of the supply chain

- competition in price

- having trouble standing out

- expansion restrictions

Do you want to run a lifestyle business or take over the world?

Your business strategy will be influenced by your end aim. If you want to achieve rapid growth, you’ll need:

- when things start to pick up, there are plans in place to boost up production.

- having access to a large sum of money (probably through equity investors)

- a long-term profit perspective (as short-term revenue will be reinvested)

Is this the correct business for you?

When you first come up with a concept for a business, you may be ecstatic, but consider the broader picture. Even though most business owners work long hours, they still wish they had more time. They, too, do not appreciate all of their responsibilities (like chasing late payments). Before jumping into a small business, think about everything it requires.

How to start a business with someone else’s idea

Franchises might be a great way to break into the industry. Some come with a step-by-step guide to running and succeeding, as well as forecasting and budgeting recommendations. It eliminates a lot of the trial and error you’d have to go through if you were starting from the beginning.

Franchises vary greatly in terms of the amount of support they provide and the expectations they have of you. Do as much homework as possible.

Testing business ideas

To help organise your earliest thoughts, think about starting a business from three angles.

Are there any show-stoppers in terms of customers, resources or finance?

1. Customers

What are their names? What method will you use to contact them? What will they pay for you, and why will they choose you?

2. Resources

Are you able to obtain the necessary supplies? What equipment will you require? Will you require contractors or employees?

How much do you think you’ll have to charge? How much will it cost to get started? Where is that money going to come from?

Keep an eye out for the future as well.

When are you going to break even? In the meantime, could your competitors undercut you? Will there be enough profit after taxes to reinvest in the company? Don’t just think about how to establish a company. Consider what happens next.

The most crucial factor is the customer.

The rest doesn’t matter until someone will pay money for your goods or services. It’s critical to determine whether or not there is a market. Customers and competitors should be included in your market research. You don’t have to conduct full-scale research right once, but it’s a good idea to get started testing the waters as soon as possible.

Why aren’t you the best judge of your concept?

Coming up with a wonderful business concept may feel like hitting the jackpot, but be cautious of overconfidence. We’re all naturally protective of our ideas and find it difficult to admit their imperfections.

When confronted with unfavourable feedback, people get stuck up on their ideas and become emotional, according to a study conducted by the Gustavson School of Business and Washington University.

What if my business idea doesn’t seem viable?

You don’t have to abandon your plan just because it fails to pass some of these conditions. With a few changes, you might be able to bring it back to life. Perhaps your target market is incorrect. Alternatively, your pricing. Think outside the box.

If your notes still don’t add together, file them away and move on to something else. But don’t get rid of anything. In a year or ten years, you might figure out the perfect technique to make it work. There is no such thing as a finished idea.

Chapter 3: How to write a business plan

It is not necessary for your company plan to be extensive. Learn how to create both a practical one-page plan and a more formal long plan.

Consider your business plan to be a map. You have a clear idea of where you want to go. All you have to do now is jot down the directions. The good news is that it doesn’t have to be highly important. This is due to the fact that there are two sorts of company plans:

- the one-page lean plan is a wonderful method to get started and generate ideas

- the more formal lengthy plan, which you’ll need if and when you need to raise capital for your business

Each one has almost the same content. You describe your target market, why they require your product or service, how you plan to reach them, who you will compete with, and, of course, how much money you expect to make.

How to do a fast, one-page business plan

The secret to creating a one-page strategy is to start small and expand as needed. Begin by listing your vision, goals, milestones, and financial projections in a few headings and bullet points.

Things will change over time, and new information will be added, so consider it a dynamic document. As things progress, keep modifying it.

A one-page business plan should include the following sections:

Value proposition

In a few plain, concise lines, make sure the reader understands the distinct value you’ll deliver. Get to the point without the language and fluff.

The problem you’re solving

Extend the scope of the issue you’re addressing. Assume you’re speaking with someone who has never heard of your concept before. What is it about your solution that hasn’t been done before that hasn’t been done well?

Target market and competition

Who are you selling to, and what are their other options? How are you going to improve your service to them? This is where you must demonstrate that you have conducted market research.

Sales and marketing

What will people find out about you? Will you make use of social media? Do your clients read trade magazines? Will you sell to them over the phone or in-person? Determine the location of your target audience and get there.

Budget and sales

Make some revenue and expense predictions. What is your profit margin on each sale? Will it be sufficient? How many sales do you need to break even? Define success using the figures.

Milestones

They’ll assist you in staying focused on the broader picture. Explain why each milestone is important, list what (or who) you’ll need to make it happen, and set a deadline for it. This will help you break down what you need to do into small chunks.

The team

Who is a part of your company and why? Write a few words for each person, detailing their objectives and responsibilities. Do this even if you haven’t filled the position yet.

Funding

Determine how much you require (or currently possess) and what you intend to use it for. When will you start making payments, and when do you think you’ll be finished?

You should keep things concise and to the point while developing a one-page business plan. If one of the parts has a lot of details, store them in a separate document. In the one-page plan, just start with a high-level summary.

It’s frequently more difficult to write anything briefly, so give it a few tries. As you go, whittle it down. Make your language simple and easy to understand. It should be understandable to a 12-year-old.

What you can fit on a single page will astound you. Use bullets, be succinct and store the specifics for later.

For some, one page is enough.

Some people start a company with nothing more than a one-page business plan. Rather than conducting extensive research, they swiftly introduce their service or product and see the reactions of paying consumers. Following the receipt of that feedback, the company quickly modifies and enhances its offering.

This lean startup model isn’t appropriate for every firm. If you want to borrow money from a bank or an investor, you’ll almost certainly need a detailed business plan.

Struggling to get started? Try a SWOT analysis.

Try a SWOT analysis if you’re having trouble getting into a flow with your planning. It’s a terrific method to get your thoughts organised and get the planning process started.

What is a SWOT analysis?

Strengths, Weaknesses, Opportunities, and Threats (SWOT) are acronyms for strengths, weaknesses, opportunities, and threats. It’s a means of looking at your company from the inside out, as well as from the outside in.

- Strengths =aspects of the concept that are particularly appealing

- Weaknesses = aspects of the concept that could be improved

- Opportunities = aspects of the environment or market that will aid the idea’s success

- Threats = environmental or market factors that will work against you

A SWOT analysis provides talking points for your business strategy as well as actual action steps for getting your company off the ground.

How to do a SWOT analysis

Divide a page into quarters to do a SWOT analysis. In the four areas, write down your strengths, weaknesses, opportunities, and threats.

So you’ve done a SWOT analysis – now what?

Your SWOT analysis is likely to have revealed some new plans, goals, or areas for improvement. Each quarter of your SWOT analysis will have something to accomplish.

- Strengths

How will you capitalise on your assets? Is there anything else you could do, such as pursue other opportunities? How can your muscles assist you in dealing with dangers? - Weaknesses

Which flaws are the most obvious? Is it possible to fix them? Will that necessitate more money, more personnel, or more knowledge? - Opportunities

Set objectives for each choice. Make sure the objectives are specific, quantifiable, reachable, and time-bound (also known as SMART goals). - Threats tend to attack your weaknesses first, so use this as another opportunity to remedy your weaknesses and reduce the risks.

These action points will serve as a wonderful beginning point for both your business and marketing plans, as they tend to develop in tandem. Starting with the one-page version is a good place to start.

Writing a more extended business plan.

You’ll have a lot better notion of how to construct a full business plan once you’ve completed a lean one-pager. You’re simply adding to what you’ve already got.

A business plan’s contents (11 essential sections) are as follows:

- Executive summary

Provide a summary of your business plan’s important points. Despite the fact that it comes first, write it last. - Company overview

Determine your business model and industry. - Products or services

Include the context in which your products or services answer the problem. Here’s where you may put your SWOT analysis. - Market analysis

Determine your target market as well as the competition’s strengths and shortcomings. - Risk assessment

What could go wrong, and how likely are those events to occur? - Marketing and sales plan

What’s your message, and how are you going to get it out there? How many sales do you think you’ll be able to make? - Milestones

What should happen and when should it happen? How will you assess each milestone’s success? - Progress reporting

When will you report on these milestones, and how will you do so? It is not necessary to be overly formal. Just make certain you’re doing it correctly. - Team

Name the individuals involved, make a note of their special abilities, and allocate duties. - Budget

Take your sales projections and illustrate how they will affect your bottom line. - Finance

Show how capital will be used to get set up and maintain operations initially. Show when debts will be repaid.

Avoid these common business planning mistakes.

- Underestimating the amount of money required to get started

- Budgeting insufficient funds for the first several months of operation

- Expecting sales to increase too quickly

- Putting too much reliance on one or two consumers (or suppliers)

- There are no plans in place to deal with unexpected delays or costs

Visit the Australian government’s page on drafting a business plan for further information, which includes templates to get you started.

Chapter 4: Getting business finance

From acquiring a loan to locating investors to crowdfunding or peer-to-peer financing, learn the fundamentals of company finance. Learn how to market yourself as well.

Starting a business might be pricey, but what if you don’t have the funds? What kind of business funding are available? What’s more, how are you going to get in touch with them?

Your business funding options

All sources of finance are not available to all businesses. For starters, you won’t be able to sell a portion of your company if you’re a sole trader or a partnership. You can’t issue share paperwork unless you’re a corporation. The idea at the heart of your business will have an impact on your funding options. Traditional lenders, such as banks, are generally uninterested in fresh concepts.

There are a variety of options for business finance, however, they can be categorised into two groups:

- Debt (lending)

You take out a loan and then pay it back, usually with interest. - Equity

You gain money when you sell a share of your business to an investor.

Pre-sales are a third means of raising funds. Customers in this case pay before you’ve created the products or services they’re purchasing. Debt and equity, on the other hand, are far more common. Businesses that have access to both favour debt.

Debt financing pros

- It’s much easier to find.

- You maintain complete control of the business.

- Profits are retained in your own hands.

- Budgeting for interest is simple.

Debt financing cons

It’s challenging to support innovative business ideas with debt financing. Banks like to put their money on safe bets. If you have a game-changing new idea, you’ll undoubtedly need to look into equity financing, private loans, or presales.

Equity financing pros

- You won’t have to pay anything back if the company fails.

- You will be able to acquire access to investor networks.

- Investors offer strategic direction.

- Investors are eager to risk their money on new ideas.

Equity financing cons

Investors gain some authority over your company, and profits must be split. As a startup, you’ll sell shares at the lowest possible price. It may feel as if you handed them away after a period of success.

Common types of bank loans

Debt finance is provided by banks in two ways:

- Term loans

When you borrow a big sum for a set period of time and pay it back in monthly instalments. Every month, the lender calculates the interest you owe and adds it to your debt. - Line of credit

You’ll be assigned a borrowing limit, and you’ll only be able to withdraw funds if and when you need them. You only pay interest on the amount of money you utilise.

How you secure the loan may affect the amount of money you can borrow and the interest rate you pay.

How will you secure your loan?

If you don’t make your payments, your lender might claim security to get their money back. It may contain items such as:

- a piece of real estate, such as a house

- other assets, such as vehicles or high-priced machinery

- a personal guarantee, which gives the lender the right to sue you if you don’t pay back your loans

The loan sizes get smaller and the interest rates get greater as you proceed down the list. However, if you offer something as security, you must be willing to lose it, therefore this is a difficult choice.

Unsecured loans are also available. A credit card is a good example. However, borrowing limitations will be lower and interest rates will be higher.

How to apply for a loan

These four items are required to apply for a startup business loan from a lender such as a bank:

A good credit score

This demonstrates your commitment to paying your bills on time.

A solid business plan

Your sales predictions, budget, and time to profitability will pique the curiosity of lenders.

A shopping list

Specify the purpose of the loan (including the cost of each item).

Security for the bank

You’ll also need to specify what actions the lender may take if you default on your payments.

How much to borrow to start a business

Your budget may be able to assist you here. It will show you how much money you’ll need to start and grow your firm, as well as how much of that money you’ll need to borrow. Take that amount and divide it by 12 to determine the monthly repayments.

To assist you, most lenders feature online calculators. The larger those repayments are, the more sales you’ll need to break even, so don’t skimp on this phase. Consult an accountant to determine how much you can afford.

Operational costs are part of business finance.

There are costs associated with beginning a business, as well as expenditures associated with maintaining it. You’ll need enough cash in the bank to get through the initial few weeks or months of business. In the beginning, there isn’t much money.

Consider taking out a loan large enough to pay initial operational costs as well. At the absolute least, double-check that you have enough credit with the bank to return to them later.

How to budget for debt

Debt isn’t something to be terrified of. The majority of firms deal with it on a daily basis. However, keep an eye on the impact of interest costs. Calculate how much interest will cost you each year and include it in your budget.

Check out what would happen to your budget if interest rates went up a couple of percentage points before you took out a loan. How much more would it cost you on an annual basis? Are you still able to make the payments?

Alternatives to banks

Are you looking for a way to establish a business without taking out a bank loan? We’ve already discussed equity (finding investors), but there are other possibilities. Friends-and-family loans, peer-to-peer lending, and crowdfunding are three of the most frequent.

Friends and family loans

Many enterprises begin with personal loans from family or friends. These are frequently agreed to on the basis of a handshake, with no security provided by the borrower. However, to avoid misunderstandings, it’s a good idea to write down the loan specifics and have both parties sign it.

The document should contain the following information:

- how much money have you borrowed?

- what it is used for (be specific)

- the interest rate, if there is one

- While calculating interest (monthly, quarterly, or annually)

- when the repayments are due (monthly, quarterly, annually)

- when the loan should be fully repaid

Peer-to-peer lending

Some websites connect those who have extra money with those who are in need. You can submit a proposal detailing how much money you require and why. Someone might back you up if they agree to put it on their site.

People who lend money through these services typically incur more risks than banks and so demand better returns. As a result, interest rates are likely to rise. However, if you have a strong proposal, this isn’t always the case. You don’t usually have to provide security as an added bonus.

Crowdfunding a business

Crowdfunding is a legal method of raising funds. It can help you obtain various sorts of company financing, including:

- Equity

You present your concept and offer equity in the company. - Presales

You present your concept and solicit pre-orders. You’ll need to specify how many orders you’ll need to start your business, and you’ll be expected to follow through if you pass that number. - Debt

You can use crowdfunding sites to pitch a concept and ask for support from the community, similar to peer-to-peer lending.

Crowdfunding works in a similar way to a popularity contest. To be noticed, you must put in a lot of effort. Don’t just throw out a pitch and hope it goes viral. You’ll need a strategy for marketing and networking.

Chapter 5: Budgeting and forecasting

(Credit: Xero.com)

Budgeting and forecasting for small business

Starting a company is a significant financial investment. Before you begin, calculate how much money it will consume and how much money it will generate. Hello, and welcome to the realm of forecasting and budgeting.

What is the business budget?

Budgets depict how the money will flow in and out of your company over time (usually a year). That money could come in the form of loans or sales revenue. It will be spent on merchandise, rent, advertising, and you and your employees’ salary. Most budgets attempt to keep spending below what comes in, although this may not always be the case.

What is the goal of budgeting?

Budgets assist you in planning for profit. For instance, they’ll demonstrate:

- how much capital is required to start a business

- how many sales do you need to break even?

- how much you can afford to put back into the company

- when you have the financial means to hire aid

The basic goal of a sales budget is to see where you’re making and spending money. Once you’ve figured that out, you can aim to do more making and spend less.

Why a cash flow budget is a good idea

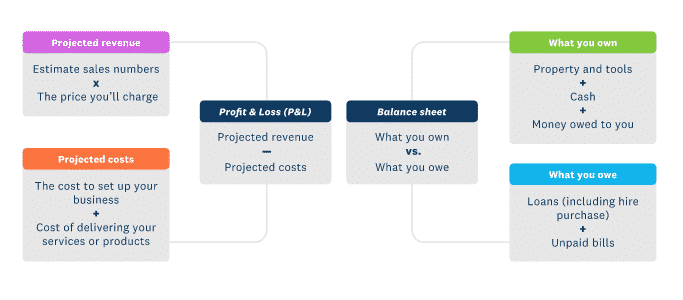

Because they illustrate whether or not you’re making money, the profit and loss (P&L) statement.

and balance sheet are the two most common components of a budget. However, a cash flow projection is also necessary. It estimates how much money you’ll have in the bank at any given time based on when you’ll be paid and when you’ll have to pay bills or employees.

Many young enterprises eventually run out of cash. A cash flow budget will help you predict when those dry spells will occur, allowing you to plan accordingly. You might put off ordering supplies, put off purchasing new equipment, or arrange for a loan or line of credit to help you get by.

How to make a budget

The more you budget, the easier it becomes. You can utilise the previous year’s experience to forecast the coming year. However, when starting a firm, you must make numerous assumptions. The goal is to avoid relying solely on conjecture.

Estimated revenue

You’ll have to put in some effort to estimate how many sales you’ll make and how much you’ll charge.

Projected costs

Calculate how much you’ll spend on items like:

- both materials and labour

- computers and equipment

- rent, energy, memberships, and licences

Make a line for petty cash to meet unexpected expenses.

P&L budget

After you’ve calculated your revenue, expenses, and expenditures, combine them in a P&L budget. Is the company going to produce more money than it spends? Of course, that is the goal, but you may not be profitable right soon. Create a separate page that demonstrates when you’ll start making a profit if you intend to lose money in your first budget.

What you own (assets)

Include stuff like:

- property, equipment, or vehicles

- the amount of money in the bank that the company has

- money owed to the company (invoices that haven’t been paid yet)

What you owe (liabilities)

Make a list of all your debts, such as:

- you’re paying back loans

- repayments payable on items such as cars

- bills you haven’t managed to pay yet

Balance sheet

On both sides of your balance sheet, some items will appear. The quantity you own is an asset, whereas the amount you owe is a liability.

Don’t just put down what you paid for your assets and forget about it when listing their value. The majority of assets depreciate in value over time. Depreciation is the term for this, and it is recorded on your balance sheet. The good news is that depreciation can be claimed as a tax deduction.

Seven common budgeting mistakes: what people forget

- Freelancers and contractors

You’ll almost certainly require assistance with some chores. Even if a company has its own employees, contractors may be needed to fill vacations or busy periods. - Transport

You must consider in transportation while visiting job sites, attending client meetings, or shipping internet orders. - Interest on loans

You must repay more than the money you borrowed. You must also pay the interest. Figure out how much it will cost. - Insurance

To safeguard your business, you may need numerous policies, and the prices can mount up. - Wastage

Don’t expect everything to go as planned. The printing on the boxes will be incorrect. Products will be thrown away. Contractors are bound to make mistakes. You’ll also have to redo some tasks. - Taxes

When you deduct costs from revenue, the gap typically appears to be significant – but keep in mind that the government also receives funds. - Depreciation

The majority of the assets that your company possesses will depreciate in value over time. If you don’t account for this, you’ll be surprised when it’s time to replace them.

The difference between a budget and a forecast

Your budget is a roadmap for where you want to take your company. A forecast shows where things are likely to go based on previous events.

There will be no gap between your budget and your forecast when you initially start off. This is due to the fact that they’ll be based on the same set of estimates and assumptions. However, as your firm grows, you’ll begin to collect real-world data and see how sales and costs are progressing.

You’ll have a better picture of where the business is going if you look at this data, and you’ll be able to adjust your predictions accordingly. You’re forecasting when you do that. Your prediction and budget will almost certainly change as time passes. When you make your next budget, you’ll put them back together.

Budget vs actuals (updating your forecasts)

The reality check lies at the foundation of good budgeting and forecasting. Compare your budget and all of its assumptions against what’s happening on a regular basis.

This is something that several companies do every quarter. Given everything else you have going on in your first year of operation, that may not be feasible. However, now is the time to be extremely frugal with your money.

Keep a mental score of budget vs. actuals throughout the year at the very least. You’re probably so familiar with the data that you’ll notice if things aren’t going as planned. Take the time to generate a fresh forecast if they do — for better or worse.

Simplify budgeting

Budgeting is simple with online accounting software. For example, Xero financial reporting compares budgets to actuals automatically and generates up-to-date reports, such as a profit and loss or balance sheet, whenever you need them.

Chapter 6: Sales forecasting methods

How do you forecast income for a startup? To assist you to improve your estimating skills, we’ll walk you through four commonly used sales forecasting methodologies.

Four sales forecasting methods for new businesses

Forecasting sales can appear to be a game of chance. There are numerous estimates, many of which are based on assumptions. However, you can take a scientific approach to it. Here’s how to do it.

What is forecasting in business?

Forecasting and budgeting work together to help you predict your company’s financial future. You begin by estimating revenue (sales) and expenses over a given time period, such as six months. That’s your baseline prediction, and you’ll use it to create a budget.

As time passes, you’ll gain a better understanding of how the firm is going and be able to change your forecast to be more realistic. Your forecast will become more positive if things are going well. Your forecasts will become more conservative if things start to slow down.

Your first forecast will most likely be the most difficult. While you can receive quotations to assist you to anticipate expenditures, it’s much more difficult to predict sales.

Sales forecasting methods and their flaws

The first thing you should know about sales predictions is that they will never be completely accurate — at least not in the long run. The goal is to keep the margin of error to a minimum.

There are a plethora of sales forecasting techniques available, but the majority of them are designed for current organisations. They expect you to have knowledge of previous sales. That is not an option for new enterprises. That leaves you with four possibilities, at least two of which you should pursue.

1. The ballpark method

Begin by determining the whole target market and working backwards to determine how many people could potentially become customers. Perform this exercise during the first three months, first six months, and first year of your life. Consult an industry insider or an accountant to double-check your assumptions.

2. The borrowed-homework method

Someone, somewhere, is doing something similar to your business, no matter how spectacular or strange it is. Their company does not have to be identical to yours, but it should be similar. Find those individuals and enquire about their sales results.

You don’t need to delve into their accounts or obtain precise figures. Begin by asking general inquiries about their company. Many business owners will open up and tell their stories.

Don’t make comparisons to outliers. If another company becomes famous for some reason, they aren’t a viable model for your sales estimates. Unfortunately, virility is not a strategy.

3. The method of working backwards (setting a sales target)

You may begin predicting by determining how many sales you’ll need to stay in business. This is more of a (minimum) sales figure than a sales prediction.

After you’ve determined the bare minimum your budget will allow, do some market research to see if that’s a realistic sales goal. You may start by contacting other businesses in the same industry. You might also approach clients directly and enquire about their purchasing habits.

If you think you’ll be able to meet the goal, you could create (or acquire) the necessary amount of merchandise and set out to sell it. Someone who is converting a pastime into a business is more likely to employ this strategy. It enables them to start small, build gradually, and keep expenses under control.

4. The ask-an-expert method

Do you know someone who has seen a lot of company plans, budgets, and projections? Accountants and bookkeepers are two types of accountants. Investors are included as well. Approach them and have a conversation with them. They are always interested in hearing about innovative company concepts.

Some experts will provide you with a free initial consultation. Even if they charge you, you’ll obtain a lot of relevant information in a short period of time, so you’ll get a lot of bang for your buck. To build your own set of approximate estimates, use one of the sales forecasting methods above and ask them for a sanity check.

Look for an accountant or bookkeeper who has experience with your industry’s clients. It can benefit if they’re also local, however, this isn’t always necessary.

In the Xero advisor directory, you can search for advisors by industry and area.

Do several sales forecasts when starting a business

You have no idea how well your new business will do, so try a few different things. Run three scenarios: one with very low sales, one with very high sales, and one in the middle.

That’s how you may start a business with confidence, knowing you’ll be ready for anything. You’ll have a rough budget in place if sales start slow. If your company grows rapidly, you’ve already considered how to accommodate the increased demand. You will learn a lot by working through the scenarios. Have a good time with them.

Chapter 7: Pricing and cost of goods sold

(Credit: Xero.com)

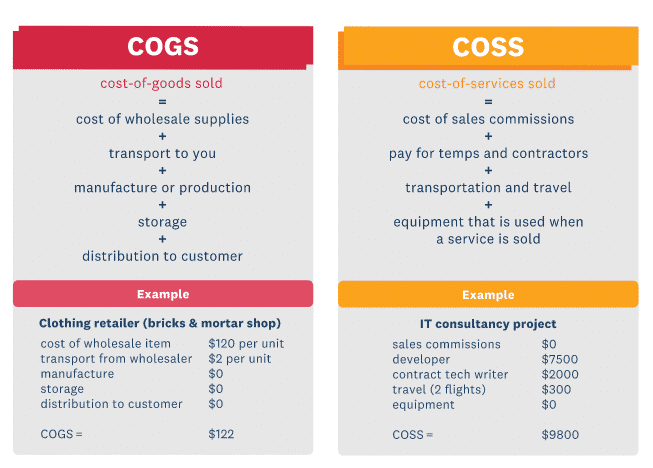

You need to know your COGS (cost of goods sold) and have a sound pricing plan if you want to earn money in business. We’ll walk you through both of them.

Pricing and the cost of goods sold

As a new business owner, one of the most crucial things you’ll do is set rates. The value you place on your products or services is determined by a number of things. None, however, is more crucial than meeting your expenses.

The first rule of price setting

You won’t make money on every sale. To get rid of stock, you may sell it at a discount. You can also have to redo a job for a dissatisfied customer. However, in general, you should make more money from a sale than you invested into it. To do so, you must first determine the cost of the things sold (also known as the sales cost).

What is the cost of goods sold (or services sold)?

The cost of goods sold, or COGS, is a measure of how much your company pays to supply items or services to clients. These direct costs are distinct from overhead costs such as rent and salary.

An excellent way to figure out if something is a COGS is to ask:

- Is this cost only incurred when a service or product is purchased?

- Is this an expense that rises and falls in tandem with sales?

If you answered yes to either of these questions, it’s most likely a COGS. There are many different types of COGS, some of which are hidden or difficult to assess. When you think you’ve counted them all, have your work double-checked by an accountant or bookkeeper. They’ll notice details you might have missed. And a miscalculated cost can mean the difference between success and disaster.

How to break down shared costs

Some of your expenses are spread out over multiple jobs or items. For example, you’ll most likely have a single transportation bill for all of your shop’s items, a single energy bill for your entire workshop, or a single piece of equipment used on the majority of your projects. A shared expense can be distributed in one of two ways. You have two options:

- distribute it evenly across all of your products, projects, and services., or

- divide it by the number of other inventory costs (so more expensive products or services carry more of the shared cost).

Working out your margin

You can start thinking about the selling price once you know your COGS. Your margin is the difference between your selling price and your cost of goods sold.

Because they produce so many sales, some businesses, such as supermarkets, may flourish with a margin of just 5%. Other businesses, such as restaurants, may require a 100% or 200 percent profit margin. Profit is not the same as margin. Overhead costs like as energy bills and office supplies must still be paid. After you’ve paid off those kinds of bills, you can bank what’s left.

Pricing Factors to consider

Your break-even point is determined by the cost of items sold. Knowing that when you’re beginning a business is quite beneficial. However, many other things will influence how you price your goods or services:

- Value versus cost

You’ve probably heard the phrase “the whole is greater than the sum of its parts.” That is true of many products and services. If you significantly improve a customer’s life or business, you have the right to charge them extra – even if it didn’t cost you anything. - Supply and demand

You can charge more if no one else does what you do and you have a large number of consumers. Just be careful not to overdo it. People don’t appreciate being overcharged, and competition will ultimately emerge. - Price-taker versus price-maker

Customers have price expectations for some sorts of everyday products and will not pay extra for them. If you’re selling a standard product, you’ll almost certainly have to compete. You can, however, influence or set the pricing if your product or service is unique. - Volume versus margin

If your company only produces five sales each week, you need a good markup every time. If you earn 5,000 sales in one day, you’re probably fine with a little profit margin.

An introduction to pricing methods

There are a plethora of pricing options available. Many companies utilise a combination of them.

Market-based pricing strategies

Find out what your competitors are charging for similar products and services, and then determine how you want to compare them. Even if you don’t employ one of them as your primary pricing approach, you’ll still need to be aware of what your competitors are doing.

- Go high, with premium pricing

You can strive to be a prefered brand that customers are willing to pay extra for. To be able to achieve this, you must obviously sell high-end products or services. - Match the market

You’ll be less likely to turn away price-sensitive customers if you put your prices at market level. When you’re selling usable everyday goods or services, this becomes even more vital. - Go low, with economy pricing

You might strive to always match or better your competitors’ prices and establish yourself as the go-to spot for bargain hunters. Just keep in mind that you’re committing to surviving on razor-thin margins, which might be difficult.

Cost-plus pricing strategies

After you’ve calculated your COGS, all you have to do now is add a standard markup to everything you sell.

- Rule-of-thumb pricing

Many businesses have agreed on conventional markup rates after decades of experimenting. You could begin by adopting the appropriate tariff for your company. - Custom markup

You could choose your own rate if your industry lacks a conventional markup rate or your market conditions differ significantly from those of your competitors. Before you lock anything down, though, double-check your numbers with an accountant.

How to start a business with movable pricing strategies

Your rates don’t have to stay the same all the time. In fact, a handful of prominent new product and service pricing schemes do the exact opposite.

- Penetration pricing

To increase sales volume, some new enterprises reduce their margins. This can quickly attract a large number of new clients. The trick is to keep them when your pricing return to normal. - Price skimming

Some businesses charge a premium price when launching a new product or service. They believe that early adopters will pay more since they want the product more. Once the aficionados have been tapped out, the company lowers pricing in order to capture the remainder of the market. - Sweetener deals

Setting prices high but offering appealing introductory reductions is a variant on these themes. It helps you to entice buyers with a discount without permanently lowering the value of your product in their eyes.

Price bundling

Many service firms like to offer a discount if you buy a few products at once. Their profit margins are reduced, but they generate more income as a result. It’s similar to offering a bulk-purchase discount. You’ll need to conduct some market research to determine which product or service combinations customers like.

Pricing methods and COGS are crucial to profitability

Whatever you do, don’t skimp on the price. In business, you have two levers to make money: margin and sales volume. Price has an impact on both of them.

Begin by calculating your COGS. To get a sale, you must know how much you spend. Plus, once you know what your expenses are, you can start looking for ways to cut them. One of the most effective techniques to increase earnings per transaction is to do so.

Chapter 8: Types of business structure

Learn how your company’s legal and tax structure will affect how you operate. We examine the advantages and disadvantages of each business structure.

When it comes to thinking about how to establish a business, few people consider structure. However, the way you run your business can have an impact on how you’re treated by the government and the law. Here are a few of the details.

Business structures and their effects

Sole traders, partnerships, and corporations are the three most common business structures. Your decision will have an impact on your administrative burden, taxation, legal standing, and ability to obtain funds by selling shares. This table summarises the key distinctions between a corporation, a partnership, and a single trader.

If you don’t choose a business structure

If you don’t choose a business structure when you start one, you’ll be treated as a lone trader. Many people begin their careers in this manner. However, it’s important to understand what it means to be a single trader and how the other arrangements work. Before making any modifications, consult a lawyer or accountant.

What is a sole trader?

A sole trader is a business with only one proprietor. It doesn’t have to be a one-person operation to hire employees.

Advantages of a sole trader

As a sole trader, you may easily set up your business and pay your taxes. You simply report your earnings on your own tax return.

Disadvantages of a sole trader

A sole trader has no special legal status, which implies that the proprietor is personally liable for the company’s actions. If the company is in debt or has legal issues, the owner is also in difficulty. Your insurance selection becomes critical.

What is a partnership?

A partnership is owned by two or more people. There are no restrictions on how it is distributed. A business can be owned by one partner who owns 99 percent of the company.

Advantages of a partnership

It’s simple to form a partnership, though an official letter outlining the agreement between partners is suggested. Taxes are also straightforward. Simply fill out a partnership tax return or report your share of business income on your personal tax return.

Disadvantages of a partnership

If the company runs into financial or legal problems, so do the partners. You can also have problems if one of the other partners makes a mistake.

What’s in a partnership agreement

A simple business partnership agreement should include the following:

- give your company’s legal name and explain what you do.

- show the owners’ names and the number of shares they possess.

- designate a chief financial officer

- specify the time and manner in which income is split to the partners

- provide a method for resolving disagreements

- choose how accounting and finances will be handled

- describe how the cooperation will be completed (and how debts or profits would be distributed)

Even a modest business partnership agreement, as you may understand, can become large and intricate. Look up examples on the internet or, better yet, consult an accountant or lawyer for assistance.

What is a company?

Because a company is legally distinct from its owner (or owners), you’re less vulnerable to legal or financial troubles. A firm can be held by a single individual or a group of people.

Advantages of a company

If something goes wrong, you’ll have some legal and financial protection — your accountant or lawyer can tell you more. Companies also pay a lower tax rate than individuals.

Disadvantages of a company

Operating as a corporation will cost you more than operating as a lone trader or partnership. There’s also extra paperwork to deal with. Before you start, you’ll need to understand how the firm will run, and you’ll have to submit documents to the Australian Security and Investments Commission on a regular basis.

Many firms begin as sole proprietorships or partnerships and expand into corporations. If your company grows and you begin to take on more sophisticated projects that provide a greater financial or legal risk, you may need to change your business structure.

Where do franchises fit?

When you purchase a franchise, you are not automatically a part of the company. You start your own company and sign a franchise agreement with the franchisor. You can establish your own business structure, or the franchise agreement may specify that it must be set up in a certain way, such as as a corporation.

Chapter 9: Registering a business

Before you can start your business, you must complete certain papers. Here’s how to avoid getting into problems by registering your business with the appropriate authorities.

You’ll have to perform some paperwork after all of the excitement of deciding to start a business. These aren’t the most enjoyable jobs you’ll face as a business owner, but they’ll keep you out of legal problems.

How to register a business with the government

Before you can start doing business, you must first complete a few formal steps:

- Register a business name

You’ll need to register a business name unless you’re doing business under your own name. The Business Registration Service can help you with this. - Get an Australian Business Number (ABN)

An ABN is a convenient way for the government and the tax office to identify your company. You should include it on your invoices to ensure that consumers do not deduct pay-as-you-go tax from their payments. The Business Registration Service can help you get an ABN. - Apply for licences and permits

Certain commercial operations, such as running a business from home or employing employees, may necessitate specific authorisation. Certain industries have highly specialised needs. The Australian Business Licence and Information Service can help you find what you’re looking for.

How do I register a company?

If you’re starting a business, you’ll need to pick a name and register it with the Australian Securities and Investments Commission (ASIC). You’ll need to provide paperwork outlining your company’s operations and identifying who will make decisions. The Business Registration Service is a good place to start.

Should I trademark a business name?

A business name and logo can be legally protected to prevent others from imitating your brand. This might be an important step for companies who want to put a lot of money into promoting their brand.

This aspect of the law can be difficult to navigate, especially if you expand into new markets and discover a competitor with a similar name. Seek legal guidance from someone who has worked in this field before.

At the absolute least, check trademark registries (and search engines) to be sure your company name isn’t already used. It’s a simple technique to save yourself a lot of time and effort.

Chapter 10: Small business insurance

When you start a business, there are a slew of things that may go wrong. There are also many of small company insurance products available.

When money hasn’t even begun to flow in, it’s difficult to think about a cost like insurance. However, many lenders, as well as the government, demand that you have some form of insurance.

Why it’s a good idea

The key to effective planning is to evaluate all options, including the negative ones. Insurance provides a chance to examine and cover your risks, just as your predictions will contain worst-case situations. Here are a few different types of small company insurance to consider.

Types of business insurance

- Property

There are policies that protect corporate premises and their contents from theft, fire, and some types of natural disasters, similar to home insurance. Because it’s typical for a company to keep all of its assets in one location, these rules are popular. - Vehicle

Most of us have had automobile insurance at some point in our lives. It’s the same for corporate cars, including coverage for loss and damage caused by accidents or theft. It should include medical treatment for injuries as well as some protection from other drivers’ lawsuits. - Public liability

If your company actions result in the loss or destruction of other people’s property, cause someone to become ill, or hurt a member of the public, this coverage comes in. Someone slipping over in your workplace or on a client’s jobsite could cause an injury. Workers are not covered by public responsibility. If you hire employees, you’ll need a separate policy. - WorkCover

This form of insurance will be required if you have employees. If an employee is injured or killed on the job, it gives financial assistance. It doesn’t take the place of appropriate health and safety measures; you must also make the workplace as safe as feasible. - Professional liability

You can get into a lot of trouble if you make a mistake at work that causes harm to others. Professional liability insurance protects you from financial loss. Businesses that provide legal, medical, engineering, and financial advice frequently use this sort of insurance. - Business continuation

Business continuation insurance can come in useful if your company is forced to close or slow down for reasons you can’t control. Depending on the policy, it may be able to replace some lost income as well as provide cash to help you get back to full capacity sooner.

Don’t put off small business insurance

Small business insurance isn’t as exciting as naming your company or finding your first customers, but it’s important to consider. Don’t go straight to a broker. First, consult with other business owners and an accountant. They’ll be able to provide you with excellent assistance to assist you in determining what you require.

Chapter 11: Small business accounting

Accounting for a small business isn’t difficult. The fundamentals are straightforward. From bookkeeping to tax, we explain what you need to do and how to accomplish it quickly.

If you’re beginning a business, you’ll need to learn at least the fundamentals of bookkeeping and accounting. We’ll walk you through the most important responsibilities, offer some time-saving tips, and explain where professionals fit into the picture.

What is accounting?

Accounting is involved with keeping track of money as it enters and exits a company. Some of the data is reported to the government for tax purposes, but the majority of it is used to assist the business owner in managing the company.

The three business accounting basics

Accounting is a broad topic, however typically boils down to the following for most small businesses:

- Keeping track of company transactions is essential (basic bookkeeping)

- Creating accounting reports to aid with business management

- Filing tax returns for businesses

Keeping records of business transactions (bookkeeping)

Making money is a fundamental goal when beginning a new business. And you won’t know if that’s the case unless you have a clear picture of your revenue and expenses. When you keep good records, you’ll be able to:

- tell you if you’re profitable, or if you’re on the right track

- notify you if you’re likely to run out of money (even profitable businesses sometimes do)

- make tax season much easier by having all of the information you’ll need to file your returns.

Bookkeeping is the term for this type of record-keeping. It’s crucial for small-business accounting, and it’s a science in and of itself.

What is the best way to perform bookkeeping for a small business?

You’ll need a technique to correctly and rapidly record transactions. For this type of activity, some businesses keep a logbook (a cashbook). They keep track of every sale and expense in it. However, there are fewer manual alternatives available.

Recording income from invoices

Make a list of everything you send and double-check your bank transactions to ensure you receive the funds. Alternatively, you can send invoices using accounting software, and the rest will be handled automatically.

Recording expenses

Transfer bank data to your accounts and use a specialised bank account for business purchases. Alternatively, have your bank deliver the data directly to your accounting software.

Keeping proof of purchase

Keep your receipts (photograph them on your phone before they go missing) and enter any further information into your accounts. Alternatively, you can download an app that will scan receipts and enter the information for you.

Cash accounting allows you to base your small business accounting on money received and spent. You can also include any money you’re waiting on or planning to spend to get a more realistic view of your finances. Accrual accounting is the term for this type of accounting.

Double-checking your numbers

One job that business owners don’t see coming when they start is bank reconciliation. It’s where you cross-reference your business books against business bank statements to make sure they agree with each other. It can chew through a lot of time, but there are smart ways to speed up the process.

Keeping the books: the early days

You’ll need to keep track of your expenses as soon as you start incurring them during the start-up of your business. It’s easiest to open a separate bank account for your company and utilise it for all of your business transactions as much as possible. As a result, business expenses and revenue are kept separate from your personal accounts.

Make sure you save your receipts and keep track of what you spent your money on. Printing bank statements and making a note besides each item is one method. Then, once you’ve set up accounting software, all of the information will be in one location and ready to be pulled into it.

Creating accounting reports to help manage the business

You’ll get a sense of how things are going once your company is up and running. You’ll be able to tell if you’re busy or not. You’ll also have a rough notion if expenditures are higher or lower than you anticipated. However, you’ll need some formal reports to back up your claims.

What are the accounting reports?

You may evaluate your company’s success using a variety of accounting and management reports. However, the following are the most common:

P&L (profit and loss) report

A comparison of your expenses and income to evaluate if you’re profitable.

Balance sheet

Determines what the company possesses (including cash) as opposed to what it owes.

Cash flow report

After all sales, spending, and loan activities have been distilled down, this figure shows if you have more or less cash.

Business dashboard

A real-time online report that tracks the performance of your chosen business indicators.

This data will assist you in making a variety of decisions, including whether or not to borrow more money, whether or not to hire help, which items or services to prioritise, and which to drop. You may easily create these types of reports using online accounting software like Xero at any time. It is always beneficial to have an accountant involved in the subsequent discussions.

Do I need an accountant?

Accountants are frequently associated with tax preparation, and they may undoubtedly assist you with your taxes. But they’re capable of so much more. They can help you generate and evaluate accounting reports, show you which data is important, and make recommendations for your company’s future actions.

And if you fear you won’t be able to afford one, reconsider. Many accountants and bookkeepers provide basic services for a low flat price, so you’ll know exactly how much it will cost you each month. Check out these guides to learn more about what an accountant performs, when to hire one, and when to hire a bookkeeper.

Filing business tax returns

Tax is the amount of money that you are legally obligated to pay to the government. It’s applied to a lot of the products we buy, it’s deducted from people’s monthly paychecks, and your company will have to pay tax as well.

Business taxes come in a variety of shapes and sizes, with some organisations encountering more than others. However, the following are three of the most common:

- Income tax

Where you pay the government a percentage of your profits. - GST

When you tack on a tax to your sale pricing and then pay it to the government later. If you’re GST-registered, this just applies to you. - Employee-related taxes

You may be obliged to pay additional taxes as the employer.

Lowering your business taxes

Make sure you account for all of your business expenses because they reduce your taxable income and, as a result, your tax burden. The importance of good bookkeeping cannot be overstated.

To calculate all of your costs, you’ll need basic accounting expertise. You can, for example, claim wear and tear on assets and the depreciation of intangible assets if you follow certain requirements.

Getting a tax professional

Many fledgeling businesses put off hiring an accountant until tax season. But don’t wait too long — they’ll already be swamped with clients who need their taxes done at the same time as you. Before you go to visit them, make sure you have thorough, well-organized records of your income and expenses. Otherwise, everyone will have a long and arduous tax season.

Chapter 12: Affordable business location

Choosing a business site might be one of the most important (and costly) decisions you make. Here are some things to consider before making a decision.

Your company requires a foundation, but how big and fancy should it be? Here are several service, retail, and manufacturing alternatives.

1. Set up an online business run from home or a co-working space

These days, a lot of things are ordered online and delivered by courier. Many services are delivered using a combination of video conferencing and internet collaboration. It’s possible that all you need is a virtual office or an internet store.

How to start a business without an office

Owning real estate is not required to start a business. A virtual office is where many consultants and online sellers work from. They use the internet to communicate and collaborate. In-person meetings are typically held at the start and end of projects and can take place at someone else’s office or a rented location.

The following are the essential virtual office tools:

- Face-to-face meetings can be held via the internet using video conferencing.

- Online papers that can be modified by numerous individuals at the same time and from any location.

- Chat services that make it simple to send and receive short messages.

- Apps that make it simple to share work-in-progress and gather feedback from clients in one location.

- Project management software that identifies who is in charge of each step in a project.

There are dozens of apps available that can help with some of these tasks. It’s best not to chop and change for different clients because it will delay you down. It’s best to master a few key systems and then ask clients to use your toolkit.

Benefits of working from home

Small company entrepreneurs may benefit from working from home. It saves you money on rent and may save you an hour or two every day on commuting. However, it is not for everyone. Being in the same area all day and night could drive you insane. It’s also possible that your home isn’t a good place to work.

Two rules to live (and work) by in the home office:

- Figure out what you need. Do you require ultra-fast internet access? Is there good cell phone reception? Is there enough room for a desktop computer or printer? A small studio? Do you have any physical document storage? Make a list of your must-haves and make sure your home office can fulfil them.

- Keep your professional and personal life separate. Make your workspace apart from the rest of the house. You don’t want to have to pack up your belongings just to provide the family dinner. If you can, stick to set work hours; otherwise, your days may become exceedingly long.

Tax and the home office

You may be eligible to deduct a portion of your rent or mortgage payments from your income taxes if you utilise a room in your house for business operations. Check out the Australian Taxation Office’s page on running a business from home.

Try a co-working space

Many places will rent you a workplace for a short or lengthy period of time. Startups and freelancers flock to co-working facilities to collaborate and refer business to their neighbours. They’re ideal for folks who enjoy the excitement of an office, and they frequently include conference rooms that can be reserved. You can find out what’s accessible in your area by conducting an online search.

2. Set up a bricks-and-mortar shop

If you want to attract clients, you’ll need to conduct market research to determine where the prospects are.

- Go toward competition or away from it?

It’s easier to steal business from the competition if you’re close by. And for your target demographic, your general location will become more of a destination. However, being the sole alternative in an underserved area might pay off handsomely. Conduct some market research to determine how important convenience versus choice is to your target market. It differs from one industry to the next. - Walk-past versus drive-up

It’s fantastic if a lot of people pass by your store every day, but it’s not so great if you sell enormous TVs and they can’t park close by. Do you want a mix of pedestrians, automobiles, and couriers, or a mix of all three? Choose a location that is convenient and easy to reach for your customers.

3. Set up a space for production or distribution

Manufacturing and logistics can be difficult to manage. Over the course of a year, extra time spent in transit or unloading a truck can significantly increase your costs.

- Make sure you’re legal

Commercial activity is not permitted in many places. Production and manufacturing are subject to a slew of regulations due to the fact that they frequently generate noise and traffic. Check to see if your activity is permitted in the regions you’re considering. Also, make certain that the facility complies with all health and safety regulations. - Figure out the costs of getting things in and out. You need to get supplies in and products out as quickly as possible. Ensure that your location is close to major transportation routes and that it can accommodate the vehicles that will be visiting. Poor loading (or unloading) bays might cause delays and put you in danger.

4. Set up an office

If you’re creating a business that requires people to meet and collaborate, the location may be a major consideration. Striking a balance between convenience and cost can be difficult.

- Do you need to be close to clients?

It can make sense to go there if you serve a specific industry and they’re all in the same part of town. Face-to-face meetings, on the other hand, are becoming less common. Consider whether being accessible is preferable to being nearby. - Is your location attractive to staff?

If your workplace is inconvenient, you may receive less applications for open positions. You may also be subjected to greater disruptions as a result of bad traffic, public transportation problems, or inclement weather. If you don’t have a large workforce or allow employees to work from home on occasion, this may not be an issue.

You are not required to sign a long-term lease right away. Renting an office at a co-working facility is a good place to start.

Budgeting and business location

Both the cost of running company and the quantity of revenue you earn are influenced by your location. When weighing your possibilities, do some budgeting.

- Real estate brokers should be able to tell you what the typical monthly leasing cost per square metre is in a certain area. Look into a few other locations to see what’s available.

- Calculate the impact of specific locations and areas on other expenditures. Is it going to be more expensive to acquire goods there? Will it be more expensive to heat a given structure in the winter?

- Determine how the new location will effect your ability to reach out to customers. A less expensive site could wind up costing you more in lost revenue. People that have worked in your business before will be able to provide you sound advise on how to strike the right balance.

Do you have room for growth?

Most new firms are on a tight budget, so leasing more space than you require at the time is uncommon. If growth is a goal, don’t forget to account for it. Look for locations that could accommodate a few more desks or equipment.

Make some backup plans in case something goes wrong. Where will you base new workers or extra supplies if your business expands? Some landlords provide flexible leases that you can break if you outgrow the building, however they usually cost more.

Chapter 13: How to find employees

(Credit: Xero.com)

Find out how to hire your first person, how to pay them, and how to budget for them. Also, come up with inventive ways to hire employees you can’t afford.

Most small firms begin with only one employee: the entrepreneur. However, you may require additional personnel straight away. So, how do you get started?

What kind of skills do you need?

The demands of the job market can be quite diverse. You might require:

- a generalist, for help with a variety of tasks

- someone with certified skills, such as a plumber

- someone with technical skills, such as a developer

- someone with soft skills, such as a sales rep

Every trade and career has its own set of labour and salary requirements. Other businesses in your field will be able to provide you with a wealth of information on how to discover, acquire, and retain the best employees.

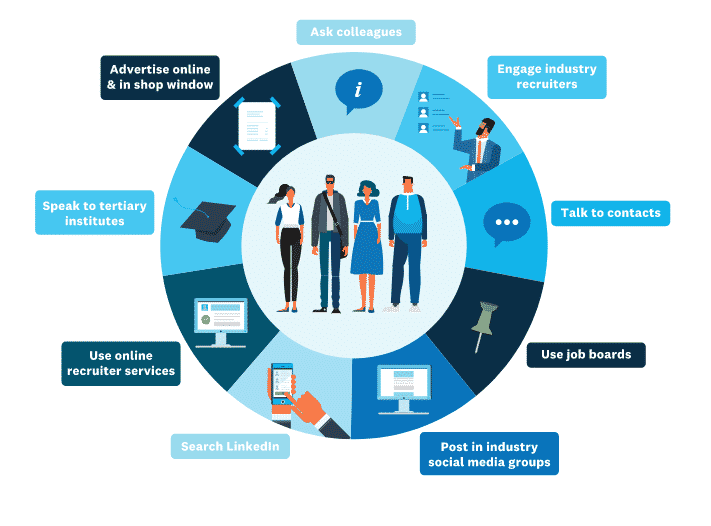

Ways to find employees

Businesses used to find staff by placing classified ads in the local newspaper not long ago. It’s no longer as simple as it once was. There are numerous in-person and online networks to choose from.

Consider offering a finder’s fee if you’re seeking to enlist the support of people in your network. You only have to pay if you hire their candidate, so the promise of a small monetary incentive can be highly enticing.

What to pay them

It’s never easy to come to an agreement on a salary rate. For many vocations, there are industry norms, but they can differ from region to region. There are many of people who are motivated by factors other than money.

What you can’t offer in terms of money, you can make up for in terms of time off, training and mentoring, or flexible hours that allow you to achieve a better work-life balance.

Payroll expenses: can you afford them?

You must first determine whether you can afford an employee before you begin recruiting. Return to your budget and include a cost for wages or salaries.

Use a website like Payscale to obtain an approximate sense of how much you’d have to pay someone. Better still, enquire at a local company that employs people with similar abilities.

Consider hiring someone part-time or hiring contractors if your budget doesn’t stretch far enough. Check out our guide on hiring a freelancer or staff.

How to start a business when you can’t afford the help

You might have a brilliant concept that you can’t carry out without the help of a specialist, such as an engineer or a salesperson. But what if you don’t have the financial means to pay their compensation or wage?

You may offer them a profit share, a stake in the company, or a deferred pay as part of the transaction. Before entering into a deal like this, be sure you have a legal agreement in place. It should include details about what will happen if the connection ends, such as who owns the work that has been completed and how much you would owe them.

Complying with the law

There are several regulations governing wages, benefits, leave, health and safety, and other aspects of employment. Checking a government website for the most up-to-date criteria is a good idea.

Begin by visiting business.gov.au.

Chapter 14: Create a website

Need to make a website but don’t know where to start? From registering a domain name to writing and launching your website, we’ll walk you through the entire process.

Treat your website as if it were an online storefront. For many consumers and prospects, it’s their first impression. Learn the fundamentals of how to create a company website, what to put on it, and how to make it profitable.

The step-by-step guide to creating a business website

- Register a web address (also called a domain name or URL). Several companies can help you register a domain name (and they often also provide hosting). Look up domain registries on the internet and go to their websites. Enter your favourite web URLs into their tools to discover whether they’re available. Claim it when you locate one that isn’t.

- Get someone to host your site

Websites are kept on servers, which are referred to as hosts. For a small annual fee, you’ll be able to find a host. Your server may also sell additional tools to assist secure your site from viruses and malware, as well as website templates. - Choose the right plan for your website. Check that you have the correct approach in place before signing a contract with your host. You can start with simple web hosting, but if you wish to add several email addresses or an online store, you may incur additional charges.

- Pick a template (or get a custom design)

Although you can have a website built from the ground up, many businesses now use pre-designed themes. There are tens of thousands of them. You may either type your text and graphics directly into the template or hire a developer to customise it to your satisfaction. - Get a logo

A well-designed, high-quality logo can make you appear quite professional. Check out design services like Tailor Brands, Fiverr.com, and 99Designs.com if you don’t have a logo. Make sure the colours and typeface you choose are appropriate for your brand. You want a theme that runs through everything you do. - Add your content.You don’t have to mindlessly follow what your competitors are doing, but you should keep an eye on them. If anything is working well for them, take note of it. Then concentrate on the ways in which you might be unique and fresh.

- Test your website. Use a variety of devices and browsers to access your website. Ensure that it appears and feels the same on all of them. Also, get honest feedback from friends and relatives.

- Hit publish

Make your site online and let everyone know about it: send out emails to your customers and connections. Check to see if there are any local directories where your website could be listed. Request that relevant business contacts link to you. - Set review and refresh dates. Set aside time in your calendar to evaluate and adjust your site. Maintain the accuracy of the data. If you bring up current events, be sure they aren’t out of date.

What goes on a website?

There are four sorts of pages on most websites:

- Home page

Include your company’s name and logo, as well as a general description of what you do and why you do it. For the time being, keep it short. The specifics can be found on other pages. Allow your individuality and passion to shine through. - Products and services

With a few sentences describing each product or service, tell visitors what they can buy from you. Product prices should be listed. If you work in services, you must decide whether or not to divulge your fees. - About

Give some background information about yourself and any professional or organisational affiliations you have. Tell your tale, but concentrate on why rather than what happened. You want your enthusiasm to be apparent. Customer testimonials can also be posted here. - Contact us

Include links to your social media accounts, as well as your email and business postal address. Many people still want to see a phone number. Include a Google map if you have a physical address. Also, make a list of your business hours.

Web writing tips

- Write less – people only read about 30% of the words on a page anyway.

- Use descriptive headings – 80% of people browsing the web scan for the info they need, so make it easy.

- Make it clean – it’s harder (and slower) to read online, so use bigger fonts and leave plenty of empty space.

Avoid the template trap

You naturally anticipate your site to look like the sample in the gallery when you choose an off-the-shelf website template. But only if your headers and text blocks are around the same length as theirs will this happen. You must adhere to the template you select; else, it will begin to appear bizarre.

Not everything on your website should sell