GST and BAS in Australia

You’re probably familiar with the term “GST,” which stands for “goods and services tax.” This tax is included in the price of almost anything that can be purchased in Australia. You probably don’t give it a second thought because it is nearly always already included in the price that is shown on the shelf.

GST stands for “goods and services tax”. The rate for the GST is ten per cent. In Australia, it is added to the majority of transactions, but not each and every one. Businesses registered for GST are exempt from paying GST on any services or subscriptions purchased from foreign vendors. It’s time to determine whether or not your company is required to register for the Goods and Services Tax (GST).

Do you need an Australian Business Number (ABN) or an Australian Company Number (ACN) to proceed? The Goods and Services Tax (GST) is often handled with cash accounting, while income taxes are handled with accrual accounting. Working out the amount of GST to add to your goods or services is easier than you think. We walk you through the process of calculating GST as well as adding GST to invoices. If you’re GST registered, you must submit a GST invoice on request.

Chapter 1: How might GST impact my company?

If you operate a company, you should be aware that it is conceivable that you will be required to collect and register for GST. This points to the fact that:

- GST should be added to your prices

- all that extra money should go to the ATO

- You are eligible to make a claim for a refund of any GST that you were required to pay for your business supplies and expenses.

How much is the GST charge?

The rate for the GST is ten per cent. In Australia, it is added to the majority of transactions, but not each and every one.

GST-free sales

There are several categories of goods and services that can be traded without the application of GST, including the following:

- foods that are essential to a diet, such as fruit and vegetables, meat, the majority of dairy products, spices, and sauces

- a selection of educational programmes and materials

- a selection of pharmaceutical and medical goods

- products and services related to finances

GST on imports

On the vast majority of imported items, you will be required to pay GST. You may be required to pay it before customs will release the shipment, and it is added to the amount you paid for the items as well as the shipping fees. When you file your return for GST, you can typically get the money back that you spent.

Businesses that are registered for GST are exempt from paying GST on any services or subscriptions purchased from foreign vendors.

GST on exports

If the products depart Australia within sixty days of you receiving payment or issuing an invoice, whichever comes first, you are exempt from charging GST on the sale of those items and are not required to do so.

Chapter 2: Registering for GST

Are you prepared to register for the GST? We’ll walk you through the process of registering, including all of the steps and methods involved.

Now that you have a firm grasp on the fundamentals, it is time to determine whether or not your company is required to register for GST and, if it is, what the following steps are and how to complete the process.

Who needs to register for GST?

- Enterprises established in Australia that have a yearly revenue of $75,000 or more

- Drivers for taxis and ridesharing services, regardless of how much money they make each year

- Organizations that do not seek financial gain and have a yearly revenue of at least $150,000

- Companies who are interested in claiming fuel tax credits

- International retailers with annual sales in Australia of $75,000 or more who are not based in Australia

If you fail to register for the Goods and Services Tax (and collect it as required), you could run into legal problems.

You are allowed to voluntarily register for GST as long as your yearly turnover is less than the requirement. It is important to consider all of your choices before making a decision about whether or not to register your company for the Goods and Services Tax (GST), since doing so will present both advantages and new challenges.

Benefits of registering

After you have registered for GST, you will not be required to pay GST on any of your business expenses. When you make the purchase, you will still be paid the price that includes the GST, but you will have the opportunity to reclaim that money back when you file your return with the ATO.

What do I need to register?

You’ll want an Australian Business Number in order to proceed (ABN). However, in order to submit an application for an Australian Business Number (ABN), you will first need to obtain an Australian Company Number (ACN) if you intend to operate your business as a corporation.

- Cash accounting

Cash accounting is a method that can be utilised by certain cash-based small enterprises. Those companies only have to pay the GST on a sale after it has been paid for by the customer. - Accrual basis accounting

Accrual-based accounting is a requirement for several types of enterprises. This indicates that they are responsible for GST on a sale either at the time they issue the invoice or at the time they are paid, whichever occurs first. - Simpler accounting method

The streamlined accounting approach can be utilised by food businesses (SAM). Check out this ATO page to see if it’s something you might be interested in.

The Goods and Services Tax (GST) is often handled with cash accounting, while income taxes are handled with accrual accounting. Although it may sound complicated, switching between the two is actually rather simple with excellent accounting software.

How to register for GST

Getting yourself registered for the GST is not only simple but also free of charge.

Registering online

- The Business Registration Service is where you may receive your Australian Company Number (ACN), Australian Business Number (ABN), and register for GST.

- Through the ATO business portal, you also have the option to register for GST.

The business site serves as the primary channel via which companies can have conversations with the ATO. Additionally, this is the location where you will file your statements of company activity (BAS). You also have the option of submitting your BAS through an online accounting programme.

Other ways to register

You can:

- use form NAT 2954 (order it here)

- call the ATO

Once you’re registered for GST

After you have become GST registered, you are required to do the following:

- include GST in your prices

- customers should be provided with tax invoices

- to keep track of your receipts and invoices so that you can get a GST refund on your business expenses.

- business activity statements (BAS) need to be submitted to the ATO.

- pay any GST owing

Chapter 3: Calculating GST and issuing tax invoices

Working out the amount of GST to add to your goods or services is easier than you think. We will walk you through the process of calculating GST as well as adding GST to tax invoices.

You are required to include GST in your prices if you are a business that is registered to collect GST. In addition to this, you are required to give GST invoices to clients so that they are aware of the amount of GST that has been applied to the bill in addition to the overall cost.

Let’s look at the math involved in both of them, as well as the prerequisites for each.

How to add GST to prices

It is necessary for you to raise your pricing by ten per cent. There is a straightforward method for accomplishing that goal.

Simply conduct a search on the internet using the phrase “AU GST calculator” to locate helpful GST calculators. This should not be done with any services or items that you sell that are exempt from GST. On this page of the ATO, you can check whether an item is exempt from GST.

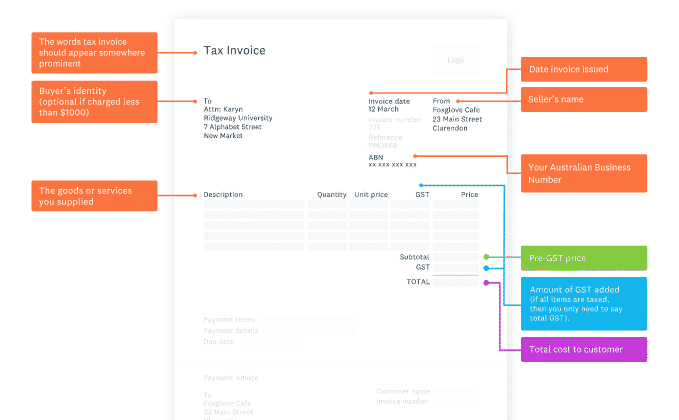

What are tax invoices?

(Credit: Xero.com)

When a customer receives a tax invoice, the amount of GST that they paid on a purchase is itemised and broken down. It is essential that you provide this information to your clients, as some of them may be eligible to get the tax money returned. If you’re GST registered, you must submit a GST invoice on request.

When all of this information is included, the document that is produced at the point of sale and given to the customer is referred to as a tax invoice. However, you can’t overlook the fact that it ought to include the words “tax invoice.”

Chapter 4: Claiming GST (and input tax credits)

Find out more information about the GST refund that can be requested from the ATO for business costs as well as the GST that you have previously paid.

Businesses who are registered for GST have the ability to reclaim the GST that they have paid on certain business expenses. In certain circumstances, you may be eligible to receive a refund of the GST that you have previously paid to the ATO. Let’s take a look at the things you can get back and the process for doing so.

When you can claim GST back

You are eligible to submit a GST claim when

- you have made an acquisition of products or services for your company (these are called input tax credits)

- you are left with a negative balance due to a customer’s purchase.

GST tax credits for business expenses

Generally speaking, GST will be applied to you whenever you make a purchase for your company. You are eligible to make a claim for a refund of the GST if you are registered for the tax. You can accomplish this by making a claim for a GST tax credit when you submit your statement of business activities (BAS). When determining whether or not you are entitled to a refund from the ATO, those credits will be weighed against the GST that you are responsible for paying.

When costs are shared between personal and professional pursuits

You are eligible to claim a credit for the portion of the goods or services that relate to your business if you purchased them for both your business and for personal use.

When GST isn’t being collected

You are eligible to collect the GST that was paid on supplies even if the finished product or service that you sell does not include the GST.

Claiming back GST on a bad debt

If you choose to account for GST via the accrual method, you run the risk of being blindsided by a bad debt at some point. For instance, you might find that your customer does not pay you after you have already issued an invoice and paid GST on the anticipated income.

Don’t be concerned; when you file your next tax return with the ATO, you might be able to get the GST reimbursed. If the consumer pays at a later date, you are responsible for repaying the GST at that time.

On this page of the ATO, you may read more about adjustments for bad debt.

Chapter 5: Calculating your GST refund or payment

With GST accounting, it is simple to keep track of the Goods and Services Tax (GST) that you have collected and paid. The fundamentals of bookkeeping and accounting for GST will be covered in this lesson.

When filing a business activity statement, which often includes the GST return, the vast majority of companies are required to account for each and every one of their purchases and sales. Let’s look at the math that you need to accomplish, as well as some useful advice regarding bookkeeping, shall we?

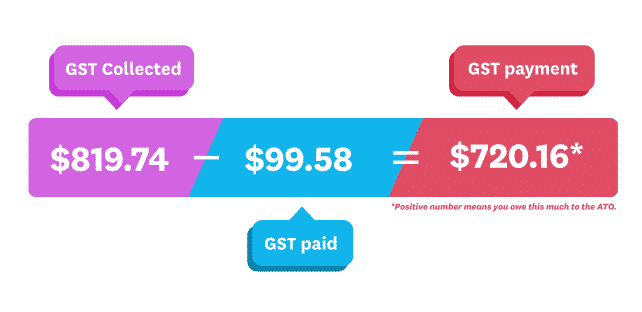

The GST is a straightforward formula.

(Credit: Xero.com)

To calculate the Goods and Services Tax (GST), you need to compare the amount you spent on purchases to the amount you made from sales.

When it comes to assets that are used for both your family and your company, like a car or computer, you might find that you need to make some adjustments. To learn more, take a look at the page the ATO has dedicated to modifying GST.

How to work out GST in four steps

- Take note of the GST that was paid on the items purchased for your firm

- Take note of the GST that was collected on the sales

- Include both forms of the GST

- To calculate GST, run the formula

Through careful bookkeeping, you can avoid unpleasant surprises.

You should strive to make a profit, just as you would with any other kind of business. If you are successful in doing that, you will almost certainly be issued a GST bill that you will need to pay. Regularly calculating the four components of the GST will allow you to:

- estimate how much your Goods and Services Tax (GST) payment will be.

- you should move money into a separate bank account.

Chapter 6: BAS: what is it and how to lodge it

There is absolutely no need for you to let business activity statements to make you feel frightened or anxious. Both the BAS reporting periods and the GST payment processes are going to be explained in detail for you.

Because your firm is subject to the Goods and Services Tax (GST), the government will need you to disclose both the amount of money that you have collected in GST and the amount of money that you have paid in GST. This is because your company is subject to the GST. You will need to fill out a business activity statement in order to fulfil this goal (BAS).

The information you need

You are required to maintain a record of the amount of goods and services tax (GST) that was paid on purchases as well as the amount that was collected from sales. Although you won’t be obliged to present tax invoices when you file your GST return, you should still make sure you have them on hand just in case you’re asked for them later. There is a chance that the IRD will make a request to investigate them at a later time.

What is a BAS?

The Business Activity Statement (BAS) is a form that, depending on the size of your firm, must be completed anywhere from one to twelve times per year. The number of times that it must be submitted is determined by the size of your company. The ATO will either issue a GST refund to you or send you a bill for the amount owed to them based on the information that is supplied on your BAS.

If you require help with your bookkeeping, you can give us a call on (03) 8568 3606 or email us on [email protected].

In addition to that, it is utilised for employee income tax, fringe benefits tax, luxury automobile tax, wine equalisation tax, and gasoline tax credits (if you are in the pay-as-you-go system).

Information you will need

You are required to maintain a record of the amount of goods and services tax (GST) that was paid on purchases as well as the amount that was collected from sales. Although you won’t be required to furnish tax invoices at the time you submit your BAS, you will still need to make sure you have access to them in case the ATO requests them. There is a chance that the ATO will make a request to investigate them at a later time.

Because your BAS may also be used for other tax purposes, it is quite possible that you will be required to give further information concerning your firm, its income, and any employees that it may have. This is because your BAS may also be used for other tax purposes. There is additional information on business activity statements that may be found on the page that was provided by the ATO.

How to lodge a BAS

You can submit your BAS through the website:

- using the online version of your accounting software

- if you’re a sole proprietorship, you can do this through your myGov account.

- through the online business portal provided by the ATO

- by having someone else, typically an accountant or book-keeper who is registered as a tax or BAS agent submit it on your behalf

What deadlines apply to BAS?

Both the frequency with which you must complete a BAS and the date by which you are expected to submit it are determined by the volume of business that you perform. Examining your business’s complete annual revenue can provide you this information.

More than twenty million dollars in annual sales.

Lodge: Monthly.

Deadlines: Within 21 days of the end of the month, you are required to file a BAS.

Less than twenty million dollars in annual sales

Lodge: Quarterly.

Deadlines:

– Quarter 1 (July-September) BAS is due on 28 October.

– Quarter 2 (October-December) is due on 28 February.

– Quarter 3 (January-March) is due on 28 April.

– Quarter 4 (April-June) is due on 28 July.

If your yearly revenue is less than $10 million, you may be eligible to file your GST return annually; nevertheless, you will still need to make a payment on the GST that you owe on a quarterly basis.

Turnover of less than $75,000 annually (or $150,000 for non-profit organisations)

Lodge: Annually.

Deadline: Submit with income tax return.

Conclusion

In certain circumstances, you may be eligible to receive a refund of the GST that you have previously paid. You can accomplish this by making a claim for a GST tax credit when you submit your statement of business activities.

You are eligible to collect the GST that was paid on supplies even if the finished product or service does not include the GST. If you choose to account for GST via the accrual method, you run the risk of being blindsided by a bad debt.

The Business Activity Statement (BAS) is a form that, depending on the size of your company, must be submitted anywhere from one to twelve times per year.

Your GST refund or bill will be determined by the ATO based on the information provided on your BAS. If you’re a sole proprietorship or non-profit, you may be required to submit a Business Activity Statement (BAS).

You must submit a BAS within 21 days of the month closing.

If your turnover is less than $10 million, you can lodge annually – but still owe quarterly instalments of the GST.