It is critical that you choose a mortgage broker that you can have faith in if you are in the market for a new home loan. There is a wide range of expertise and experience among brokers; some brokers are just more skilled and experienced than others. So the question now is, how exactly does one go about locating the most qualified mortgage broker in Melbourne?

The brokers leverage top mortgage broker software to help ensure they’re getting you the best rate. These experts will assist you in obtaining the most favourable terms possible on a mortgage and will guide you through the whole application process. Therefore, if you are considering purchasing a property, make it a point to speak with one of these real estate agents.

In the interest of saving you time, we have created a list of the top mortgage brokers in Melbourne.

Ultimate List of the Best Mortgage Brokers in Melbourne

EWM Accountant – Mortage Brokers Melbourne

03 9568 5444

Why Choose Us?

Because we are a business that specializes in taxes and financial advice, we never try to fit round pegs into square holes. We tailor our processes to meet the requirements that are unique to your company. Do you want to get your files delivered by Dropbox®? That is completely doable for us.

Do you favour the more traditional method of receiving communication through the mail? In addition to accounting services, do you require assistance with bookkeeping or only payroll? There is hope because of us. Do you also require assistance with finances? Not an issue.

Background

The Chartered Accountants at EWM Accountants and Business Advisors provide assistance to small businesses in meeting their accounting, bookkeeping, and taxes requirements. We are professionals in assisting small businesses and specialize in the construction, investment, medical, dentistry, and manufacturing industries. Our company was founded more than 30 years ago, so we have extensive experience in this field. The company has its headquarters in the lively neighbourhood of Oakleigh in Melbourne. Its members are all highly qualified accountants who bring a lot of knowledge to the table to assist us in realizing our goal.

Our Values

- Passion:

- We feel dedicated, excited and motivated about what we do, seeking joy, meaning and significance in our work. We love what we do!

- Integrity:

- In all our pursuits, we act with honesty, seeking to be truthful and open.

- Enrichment:

- We build lifelong knowledge and ability through education, mentorship and work experience.

- Loyalty:

- We embrace a sense of commitment, connection and dedication to our clients.

- Ownership:

- We are proactive, dependable and responsible in all aspects of client service.

- Teamwork:

- True success comes from the interdependence of individuals working together as a team. We value listening, understanding and mutual collaboration.

Proper Finance – Mortgage Broker Melbourne

03 8620 9099

Making a large purchase might be intimidating. But, unfortunately, there’s always a lot to think about when it comes to taking out a loan, whether it’s for refinancing, downsizing, investing, or purchasing your first home. That is why it is critical to work with a professional who is familiar with the financial business and can help you discover a loan that meets your demands and fits your lifestyle.

We want to help you locate a loan that matches your needs and surpasses them in terms of rate, product, and service. Proper Finance believes in giving you options, and we look forward to assisting you in realizing your goal of purchasing a house or an investment property. Please continue reading to learn how we can assist you, or visit our Contact Us page to get started right now.

Services

- Supporting First Home Buyers

- Investment Loans

- Commercial Loans

- Standard Variable & Fixed Rate Loans

- Honeymoon Loans

- Bridging Loans

- Asset Finance

Why Choose Us?

We are devoted to providing you with the best home loan to match your needs, whether you are a first-time home buyer or a seasoned investor. We’ll go over every element of your loan with you and make sure you’re clear on everything, including low-interest rates, offset options, limitless extra deposits, and redraw options. In addition, you can count on us to offer you with excellent customer service throughout the life of your loan, and we will continue to assist you in attaining your long-term objectives.

We differentiate ourselves from the competition by focusing on the needs of our clients in all that we do. Our pledge to you, our customers and borrowers:

- We will make it simple for you to do business with us; you will be able to communicate with a real person; we will respond to your inquiry; we will always go the additional mile for you; and we will pay attention to what you need.

- We can supply home loan solutions that are tailored to your specific requirements, and we will locate competitive interest rates.

- We are dedicated to providing you with excellent service and ensuring that you are completely content with your assistance.

In the home, we have a specialized crew. One of our helpful brokers will answer your question when you phone us. We will guide you through your entire loan application or re-finance process and provide you with the assistance and advice you need in the future.

You can feel confident that you are in safe hands, and we will find the loan that’s right for you.

Owlbroker – Mortgage Broker Melbourne

0490 527 699

We provide service throughout Australia. We are a brokerage situated in Melbourne. We major emphasise providing excellent client service and well-thought-out strategic financial solutions.

Owlbroker will look after you from start to finish on your financial journey. We have the experience and understanding to discover the best solution for your requirements. It is our great pleasure to assist you at every turn.

Financial Services:

- Residential loans

- Investment loans

- Commercial loans

- SMSF

- Personal / Car / Boat loans

- Equipment loans

Frequently Asked Questions About Mortgage Brokers

What exactly does a mortgage broker do?

A mortgage broker is an intermediary who brings together mortgage borrowers and mortgage lenders. Mortgage brokers do not use their own capital to originate mortgages; rather, they bring together mortgage borrowers and mortgage lenders. A mortgage broker is someone who helps borrowers connect with lenders and looks for the greatest possible match in terms of the borrower’s financial status and the interest rate requirements that they have.

Is it worth using a mortgage broker?

You can save time and money by working with a mortgage broker. Cons to consider include the possibility that a broker’s interests are not aligned with yours, that you may not obtain the best bargain, and that estimations may not be guaranteed. Take the time to speak with lenders directly to learn more about the available mortgages.

Do mortgage brokers do pre-approvals?

You must consult with either a mortgage broker or a lender in order to get pre-approved for a mortgage. They will ask you a number of questions, and you will need to supply some supporting evidence to assess how much of a mortgage loan you will be able to afford to take out to buy a house.

Should I talk to more than one mortgage broker?

When negotiating with individual lenders, having many offers in hand gives you more negotiation power. Applying to too many lenders, on the other hand, might result in credit inquiries that reduce your score and a barrage of unsolicited calls and pitches.

Is a financial advisor the same as a mortgage broker?

The term “mortgage broker” is sometimes used to refer to these individuals; nevertheless, there is no substantive distinction between an adviser and a broker. The term “mortgage adviser” or “mortgage broker” refers to a specialized mortgage expert in most cases; nevertheless, some independent financial advisers (IFAs) also provide the same type of mortgage assistance.

Melbourne Mortgage Advice Broker

melbournemortgageadvice.com.au

1800 693 000

For more than 20 years, has been the industry leader in providing advice and counselling on home loans. Jon is an established property finance specialist and a fully certified mortgage broker, having formerly held the position of Manager at ANZ Bank. on cultivating long-term connections with clients and exerting unrelenting effort to facilitate the success of homeowners and investors. Jon has assisted a large number of people in accomplishing their objectives by providing loans with reasonable terms, favourable interest rates, and outstanding service.

- There will be no high-pressure sales tactics, just excellent mortgage advice.

- We work on YOUR behalf. A lender sells you things.

- Mortgage Broker with MFAA Accreditation

- Intelligence about professional mortgages and resources for real estate

- A reduced interest rate in addition to an improved home loan structure

- Mortgage guidance and help from industry professionals at every stage of the process

Why Choose Us?

- We don’t charge any fees to our customers. Instead, we are compensated by the lender that wins your business, and our compensation is completely disclosed.

- Melbourne Mortgage Advice recognizes the value of your money and takes a cautious approach to guarantee that your best interests are served in all we do.

- With over 20 years of experience working as a mortgage broker in the Melbourne property market, we understand how it works and help our clients bridge the gap between homeownership dreams and bringing them to reality.

- We look after you every step of the way, from the initial planning stages through the delivery of the keys.

- Unlike many mortgage brokers, we hold current accreditations with and regularly use multiple lenders and have access to many more on our panel who offer a range of loan types to assist in various situations.

Blutin Finance – Mortgage Broker Melbourne

0435 916 755

We are a small, independent mortgage brokerage dedicated to assisting you in finding the best house loan, investment property loan, commercial property loan, or business loan for you. We have all of the expertise necessary to make your trip as seamless and comfortable as possible as seasoned experts. We take the time to learn about your financing requirements, work with you to understand your alternatives and find the most cost-effective loan solutions for you.

First-home buyers

It might be scary to enter the real estate market for the first time. But, it doesn’t have to be that way, and having a companion who can hold your hand through the process will make it a lot less stressful and even thrilling. Blutin Finance can walk you through the whole process, including any government assistance available to first-time homebuyers.

Business Loan

Business owners or aspiring entrepreneurs might apply for a business loan and utilize the cash to make gradual changes, such as launching a new firm or expanding an existing one. If you’re thinking about establishing a new business or expanding an existing one and need cash, a business loan can help. For example, suppose If you currently own a business and need money to buy equipment, recruit employees, expand, remodel, buy cars, buy a commercial property, or do other thing. In that case, you should apply for a business loan. Your company loan might have a fixed or variable interest rate, just like your residential loan.

Types of Business Loans

- Line of Credit/Overdraft

- Term Loan (secured or unsecured)

- Lease financing (Asset finance)

Aspiire – Mortgage Broker Melbourne

1300 733 942

Getting a mortgage may be a complicated and time-consuming process. Because there are many different banks, offers, promotions, and credit requirements, it is essential to have a helpful professional who can take you through the process of making an educated choice.

Get friendly home loan support.

- Expertise in a variety of home loans, including those for wealth building and investment, mortgages for first-time homebuyers, and business lending

- Advice for those purchasing their first property

- Support that is both proactive and welcoming.

- Serves your interests, not those of the banks

- Not associated with the ownership of a franchise or a bank

We make it easier

Do you want to see an improvement in your finances? The correct home loans might assist you in reducing your monthly expenses and increasing your wealth. We also assist yous.

- If you don’t do it yourself, you’ll save time and your credit fil.

- Investigate your alternatives and the amount you can borrow at each of the banks.

- Determine how much money you might potentially save.

- Choose based on the information you have.

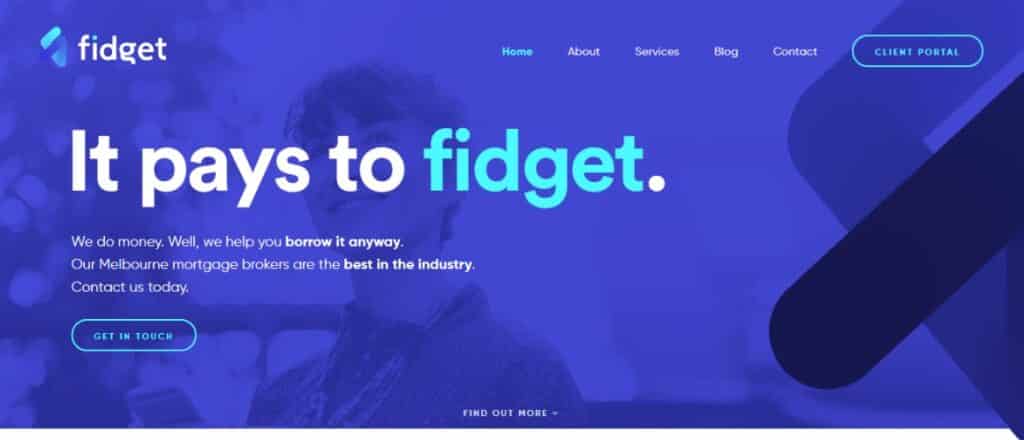

Fidget – Mortgage Broker Melbourne

1300 129 459

We serve as a link between you and over 40 lender ands your wealth of expertise and supportive friends (not in a creepy way).

We’re Different

It’s not only about bringing you in touch with someone who can lend you money at Fidget JP Partners. Our Fidget mortgage brokerage staff is here to help the process of refinancing or purchasing a house go as smoothly as possible.

We’re Multiple-award-winners

Our award-winning mortgage brokerage is here to explain your lender alternatives and assist you choose an outstanding loan structure. In addition, our professional support staff manages your loan application from beginning to end.

We’ve Been In Your Shoes.

In addition to having a specialist support staff that will handle your loan application from start to finish, our mortgage brokerage, which has won awards at the national level, is available to assist clarify your lender alternatives and choosing an excellent loan structure.

At your service

Customers in all parts of Melbourne may use Fidget Money for refinancing, house loans, investment loans, construction loans, vehicle loans, insurance, and conveyancing (and yes, we do in other states too).

- Refinancing

- Home Loans

- Buying Your First Home

- Investing in Property

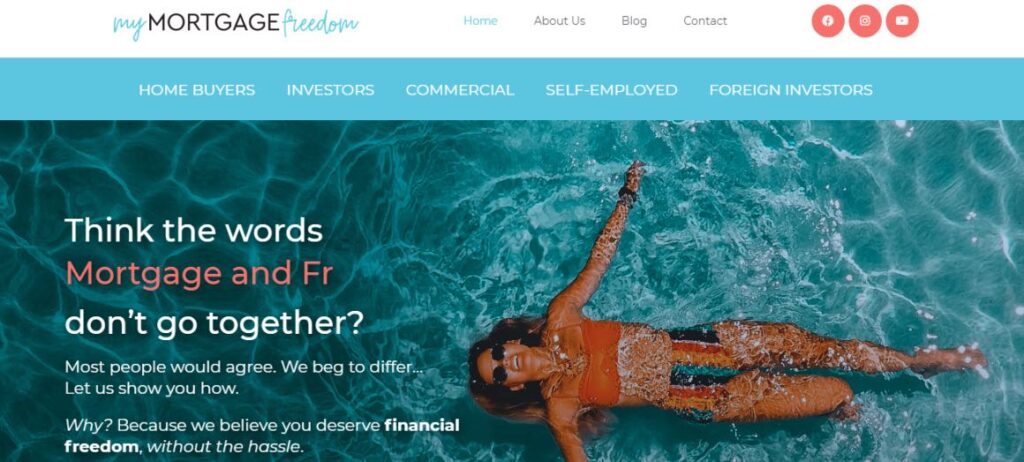

My Mortgage Freedom – Broker Melbourne

03 8256 1914

After the terms of your loan have been resolved, our work is not done. We have always made it a point to check in with our customers at least once every year to ensure that their loans continue to be affordable and determine whether they have experienced any changes in their circumstances that require our attention. Most significantly, because the interest rates often go up as the months and years pass, we have taken measures to ensure that this will never happen again. My Mortgage Freedom clients have unrestricted access to Australia’s first and only rate tracking tool, which My Mortgage Freedom developed.

This indicates that you can activate Rate Tracker on your home loan or investment loan to monitor your interest rate in real-time and shield you from any excessive interest rate spikes that may occur. This is all handled automatically, and the only time you will receive a notification is if the rate of interest you are paying is beyond the threshold that is considered acceptable.

We take care of all the leg work for you.

Whether you’re buying your first home, refinancing, building, or investing, a big ‘guy’ or a little ‘guy’, My Mortgage Freedom will get you there faster and easier. We’ll assist you in locating the greatest price, handle all of the grunt work for you, and provide ongoing assistance until the transaction is completed.

- Home Buyers

- Investors

- Commercial

- Self-Employed

- Foreign Investors

Mortgage Broker Melbourne Net

mortgagebrokermelbourne.net.au

1800 111 626

Since 1999, we’ve been serving Melbourne’s CBD and nearby areas. We are not a multibillion-dollar enterprise with a national footprint. Instead, we are a small, flexible Melbourne company that provides a mobile service as well as the option of meeting us at one of several handy CBD locations.

Get the right home loan for you.

- Competitive interest rates.

- Expert advice and guidance.

- Hassle-free.

Our service is free.

Melbourne mortgage brokers charge no fees. However, the lender you pick pays us a commission, which we clearly disclose to you. (Fees from the lender and the government may be required.) We strive to save money for our clients by taking the time to individually negotiate the best attainable pricing rather than accepting the standard cost offered.

Mel Finance Services – Mortgage Broker Melbourne

1800 940 752

We are a group of highly experienced mortgage brokers who assist our clients in obtaining the finest loans at the lowest rates possible. From first-time home buyers to retirees, we take a highly personalized approach to helping customers at every step of their property journey. We engage with businesses and investors, providing a specialized service aimed to deliver the most up-to-date industry information and market recommendations. Mel Finance invites you to discover more about us and how we may assist you. Book a free appointment with a Melbourne-based mortgage broker to explore your requirements.

Finance Services

- LOAN FOR YOUR HOUSE. Whether you’re a first-time home buyer, an investor, or a multi-property owner, get the best price on your mortgage. Our team is a group of Melbourne-based mortgage brokers that can assess a variety of lenders to get the best offer.

- REFINANCE. Is it possible to find a better deal? Find out by speaking with our trained staff about your refinancing alternatives. From researching your choices to finalizing your refinanced mortgage, we’ll be there for you every step of the way.

- INVESTMENT AND BUSINESS. We help with entrepreneurs and investors to find and manage the right financing for you. Our experts can provide specialized assistance as well as the most up-to-date market information.

First Home Buyers

We are aware that buying your first house is an event that can be both exhilarating and frightening at the same time. The staff at Mel Finance guides first-time homeowners in Melbourne through the process of obtaining a house loan and purchasing their first property. Through collaboration with our reliable mortgage brokers, you will be able to acquire the financing necessary to purchase the property of your dreams at an affordable interest rate.

Our Focus Is You

Our goal is to provide residents of Melbourne with a service that is both effortless and stress-free, guiding them through every stage of the refinancing, mortgage, or loan application process. We put our customers’ requirements first and work hard to secure the most favourable terms for them.

Why Mel Finance?

We are the foremost authorities in our field, and our sole mission is to provide the finest assistance and deals that can be found in Melbourne. Because we have been approved as a mortgage broker by the MFAA (Mortgage and Finance Association of Australia), we are in full compliance with the criteria set by the industry.

Mortgage Finesse – Broker Melbourne

3989 509 346

It’s easy to become perplexed with all of the information available. That’s why, at Mortgage Finesse, we do all of the legwork for you. As a result, we have access to a selection of loans from over thirty different lenders around Australia at some of the best rates, which may help you achieve your financial objectives faster.

We specialize on providing excellent customer service and assisting clients. We maintain long-term connections with our clientele. Our service extends beyond settlement, which is likely why so many of our clients come back again and again.

Instead of wasting hours travelling from bank to bank, sit down with us and let us help you locate the best offer. Time is a valuable commodity. We understand. Save time for yourself by letting us handle your mortgage requirements without the hassle. It’s what we’re good at.

Our Services

- Purchases

- Refinancing

- Line of credit

- Equity Loans

- Construction Loans

- Personal Loans

- Asset and vehicle finance

We’ll prepare and walk you through every step of the process. contact us

VDA Finance And Capital – Mortgage Broker Melbourne

1300 832 536

Suraj and Karna bring their combined 15 years of experience in the residential and commercial mortgage business to manage a team of brokers that will guide our clients through the property-purchase process. We recognize that each customer’s circumstance is unique. As a result, we can give customized loan comparisons and specialized lending options using our broad panel of residential and commercial lenders. Our consultations are free of charge, and our services are also free.

What We Offer

- Home Loans

- Commercial Loans

- Business & Equipment Finance

Aussie – Mortgage Broker Melbourne

13 13 64

From humble beginnings, great things may emerge. For example, the song “We’ll Save You” had a significant impact on us back in 1992, and even now, over 30 years later, it continues to do so.

- Our home loans

- Insurance

- Vehicle

- Business loans

- Insights

Go straight to Aussie

- Aussie’s home loans

- Property Reports

- Comparing Home Loans

- Compare rates available with Aussie.

Opulent Finance – Mortgage Broker Melbourne

03 8838 3592

We are a welcoming group that places a primary emphasis on satisfying the requirements expressed by our clients. We are committed to going to any and all lengths necessary in order to find the optimal solution for each of our clients. Because of this, everyone of our clients tells their relatives, friends, and coworkers about our company, which has been a significant contributor to our expansion over the years.

The highly seasoned staff here at Opulent is quite pleased of the fact that we have retained more than 98 percent of our customers. We are very proud of the awards our company has received from within the industry; however, the aspect of our business that brings us the most joy is the fact that when we work with a client, we typically begin a long-term partnership with them, during which we assist them with their financial matters as well as those of their families for a number of years.

You will not be charged for our advice, and we do not show favouritism to any financial institutions on our panel. Our top priority is to determine which of the available options will work best for you. Through our partnership with Opulent accountants, each and every one of our clients is able to take advantage of our years of experience and specialized knowledge in the fields of accounting and taxation. You will receive all that is advertised from us.

Our Services

- Commercial Finance

- Equipment & Asset Finance

- Home Loans

- Investment Property Loans

- Personal Loan

Investors Mortgage Broker Melbourne

1300 468 463

Since 2007, Investors Mortgage has assisted first-time homebuyers as well as investors with the goal of developing exceptional mortgage options for Australians. This mission serves as a primary impetus even in the present day. Since its inception, Investors Mortgage has prioritised partnering with the nation’s most innovative and ethical lenders. Because of this, we are considered to be one of the most recognized mortgage brokers in the nation.

Our proposition to our clients:

- We don’t charge any fees from our clients for our services. Instead, we get paid from the Bank or the Lender.

- We don’t add any margins to any loan products that we offer.

- We don’t push any particular lender or their products over another.

Investment Loans

- Investment Loans

- Self Managed Super Fund Loans

- Development Loans

- Construction Loans

- Commercial Property Loans

- Home Loan Calculator

Vehicle Loans

- Business Car Finance

- Car & MotorBikes Loans

- Boats Caravans & Motor Home Loans

- Trucks and Trailers Loans

- Commercial Vehicle Loans

Commercial Loans

- Business Equipment Loans

- Trucks and Trailers Loans

- Commercial Vehicle Loans

- Commercial Property Loans

Why we are one of the best in Australia:

- In order to provide you with the most recent information, we make use of the most advanced mortgage processing technologies.

- Our financial offerings range from the straightforward to the spectacularly straightforward. We have expertise with residential property purchases as well as purchases of commercial real estate. We have an understanding of the requirements placed on today’s investors, and whether this is your first time purchasing a property, we will assist you in acquiring financing for the house of your dreams.

- We offer you the most competitive interest rates, which will result in the most affordable monthly mortgage payments.

- We make available to you the appropriate resources, such as a house loan repayment calculator, to enable you to compare the interest rates applicable to home loans in Australia.

- We make available to our clients a First Home Buyer Guide as well as an Investment Property Purchase Guide, in addition to calculators that can be used to determine their borrowing capacity and offer answers to fundamental queries such as “How Much Can I Borrow?”

We work with integrity, honesty, and a strong dedication to excellence. We never put profit before of quality. Because of our established reputation, we have a lot of clout with our lenders. We design financial products with the end-user in mind, so you can be confident you’re getting the best loan available.

Inovayt – Mortgage Broker Melbourne

1300 354 354

While building what has become a successful mortgage company in its own right, the company’s founders saw the need to provide their customers with more comprehensive solutions. As a result, Inovayt Wealth was established in 2012 with the purpose of providing clients with financial guidance.

Since then, Innovate has expanded its workforce to include over forty people, established a presence across the country with four locations, and launched a commercial financing segment to bolster further the services we provide to our customers.

Finance

- Your First Home

- Your Next Home

- First Time Investor

- Experienced Property Investor

- Refinancing

- Busy Professional

- Self-Employed

- Pay Off Your Loan Sooner

- Your Next Car

- Personal Loans

Wealth

- Your Goals

- Financial Planning; what, why, how?

- Superannuation

- Personal and Business Insurance

- Estate Planning

- Investment Advice

- Budget & Cash Flow

Commercial

- Business Loans

- Business Overdrafts

- Business Investment Loans

- Development Finance

- Cash Flow Lending

- Asset and Equipment Finance

- Investment Planning and Advice

Why choose Inovayt?

- You are in good hands with us.

- We make it easy for you to do business with us in person, over the phone, or online.

- Throughout your whole financial journey, we will be here to assist you with expert advise so that you may put our knowledge to use and become successful financially.

- You are backed by a committed group of industry experts familiar with how to complete the task at hand successfully.

- All of your financial requirements may be met by utilizing our end-to-end solutions.

Mortgage Corp Broker Melbourne

3456 463 635

When others are downsizing, reducing expenses, and living on a budget, we specialize in assisting successful full-time professionals in purchasing 1 to 5 investment properties in 5 years [through smart financing] so that they can have consistent passive income before retiring and continue to live the life of their dreams even after retirement.

Successful professionals will lack a clear roadmap for starting and growing a profitable property portfolio without our help, will waste valuable time (up to ten years) not getting on the right track to financial freedom, or, even worse, will receive bad advice that will lead to an endless cycle of stress, wasted time, money, and opportunities.

Unlike other banks and mortgage brokers, Mortgage Corp is committed to provide you with a holistic investment outcome, which may include.

- Premium interest rates at a discount

- Fees are reduced or waived.

- Loan terms that are flexible and serviceable

- And a lending arrangement that maximizes further property investment potential while facilitating tax savings.

In other words, Mortgage Corp allows you to swiftly grow your property investment portfolio, helping you to attain financial independence sooner.

Home Loans

- Home Buyers

- Refinance Home Loan

- Self Employed Home Loan

- Home Loan for Medical Professionals

- Interest Rate Advice

Investment Loans

- First-Time Investors

- Experienced Investors

- High-Income Investors

- Commercial Property Loan

- Strategic Loan Structuring

Loanscope – Mortgage Broker Melbourne

03 9988 5325

In Melbourne, we have a team of Mortgage Brokers. We set the bar for finance brokerage by delivering on our promises of excellent service, competent advice, and custom-tailored loans at extremely cheap rates. We:

- Customize and personalize your services.

- Take a long-term perspective.

- Compare mortgages from over 30 different lenders.

- We can offer competent counsel with over 30 years of combined industry expertise.

- Have a strong track record of approving house loans

- We simplify the procedure.

- Our office is conveniently located on St Kilda Road, just 5 minutes from the CBD, but we can also travel to you if necessary. We also provide after-hours appointments.

- We are constantly looking out for your best interests.

- Are members of the Australian Finance Brokers Association.

- All of our clients received complimentary Rp Data property reports and credit files.

Loanscope has established a great reputation and excellent ties with major banks, non-bank lenders, and non-conforming lenders as a rising finance brokerage. As a result, we have access to hundreds of home loan packages and the experience to identify one that meets your current and future financial goals. In addition, we may recommend qualified conveyancers, accountants, financial advisors, and other specialists to complement our service.

Loans We Offer

- Home Loans for Doctors & Medical Professionals.

- Investment Home Loan

- Upgrade your home with ease

- Refinance your home and start saving!

- Commercial loans

- First Home Buyers

- Extension and Renovation loans

Would the following help your real estate investing:

- Advice from a subject matter expert who is on your side and is concerned about your objectives and future?

- Simple explanations that clearly outline your options?

- Expert guidance customised to your unique structures and objectives?

- Detailed analysis and planning?

- Greater access to mortgage possibilities than any lender is able to provide?

- A professional on your team for difficult negotiations?

- A simpler way to get mortgages you can actually afford?

Our knowledgeable consultants from Melbourne can visit you and meet with you whenever and wherever it is most convenient for you.

Why choose Loanscope?

We operate in your best interest – because what’s truly best for our clients is best for our future. Our repeat customers and referral-driven growth prove we’ve made the right choice.

As expert mortgage brokers with years of experience, we have access to hundreds of loan products you can choose from – whether you are investing for personal or business reasons. So you get access to the full market spectrum, not just the over-advertised basics.

Accession Finance – Mortgage Broker Melbourne

03 9397 2535

Accession Finance will assess your financing requirements and compare different lenders to discover a solution with the greatest features, alternatives, and pricing.

Our expertise in the sector has taught us that there is no such thing as a “one size fits all” solution when it comes to financing. For example, we’ve worked with self-employed customers have a small deposit, are first-time home buyers, and are building a new house, and in each case, we’ve looked into the best solution for their specific needs.

In most situations, we are compensated by the bank through a commission; we do not charge our clients any additional fees to locate and arrange personal financing.

Our Services

- Residential Finance

- First Home Buyers

- Investment Finance

- Construction Loans

- Car & Personal Finance

- Debt Consolidation

- Self Managed Super Funds

Our Service Guarantee

To deliver a service you can rely on and an experience in which you always come first. We believe we stand out because of our rapid response times, in-depth industry expertise, and ability to discover the correct financing for our clients.

Resolve Finance – Mortgage Broker Melbourne

1300 883 463

We’re here to find solutions, offer options, help you make better-informed decisions, and ensure you and your family can live your best lives.

Home Loans

- Find a broker

- Our lender panel

- My home plan

- Your first home

- Your next home

- Refinancing

- Investing

- Our home loans

Conveyancing

- Buying your home

- Selling your home

Become a business owner

- Why a Resolve franchise?

- Franchise partner stories

- Franchise opportunities

- Your next steps

Because we work to find solutions to problems, our company is called “Resolve.” On the path to whatever comes next, homeowners, house purchasers, home builders, homeowners who renovate their homes, and investors all confront obstacles that we are here to help overcome.

Loan Market – Mortgage Broker Melbourne

0408 206 353

Does your house loan meet your needs? We are aware that each customer will come to us with a unique combination of requirements and concerns, and we take pleasure in our ability to locate the financial solution that is most suited to their needs.

We have more than 10 years of expertise in the financial industry and have seen numerous ebbs and flows in the Australian house loan market throughout that time. You can rely on our experience, skill, and understanding to help you with any aspect of your finances, including locating the ideal first house loan, next home loan, or investment loan.

Most Popular Calculators

How much can I borrow?

It is essential that you are aware of your borrowing capacity as a figure since this tells you how much you are capable of spending on a piece of real estate.

How much are my repayments?

Your future repayments are dependent on a number of circumstances, and using our loan repayment calculator will assist you in estimating what those future repayments will be like.

How much could I save by refinancing my home loan?

The interest rates, fees, and terms of repayment for each type of loan are all unique. Utilize our loan calculator to compare the costs and benefits of many loans side by side.

Home Loan Calculators

Mortgage Deferment Calculator

You may use this calculator to figure out how much it will cost you to take a deferral, which is often referred to as a break or holiday.

Loan Repayment Calculator

Find out how much your monthly payments will be on your home loan and the total amount of interest that will be charged on the loan.

Borrowing Power Calculator

Determine how much you would be able to borrow for a house loan of that size and how much the monthly payments would be.

Stamp Duty Calculator

Find out how much money you need to set aside for the Stamp Duty and the criteria that apply in your state or territory.

Split Home Loan Calculator – Fixed vs Variable

The calculator for the split loan will compute the needed repayments as well as the total interest that will be charged to you under a variety of various rate situations, both fixed and variable.

Lump-Sum Repayment Calculator

Additional one-time payments, often known as lump-sum payments, can cut the total amount of interest you have to pay as well as the total length of your mortgage loan.

Mortgage Offset Calculator

When applying for a mortgage, having an offset account may be a very useful tool to have.

Extra Mortgage Repayments Calculator

By making additional payments toward your loan balance, you may cut the amount of time you’ll have to pay it off by years and save thousands of dollars each month.

Examine the costs associated with two alternative mortgage options.

When considering both the interest and the costs associated with the loans, compare the two options to see which one offers the better deal.

The Australian Investment and Lending Centre – Mortgage Broker Melbourne

55 612 125 242

The correct loan structure relies on individual goals and circumstances, just like any other financial plan, so receiving the right guidance is crucial. By chatting with you and understanding your present financial state and future goals, we at ALIC specialize in working with you to design the most appropriate finance plan and structure.

We collaborate with your trusted advisers or provide you with access to ALIC’s trusted market professionals, such as financial planners, wealth management/tax accountants, buyers’ advocates, and other experts, to guarantee these arrangements operate. What matters is that you have access to experts who can assist and guide you through the process. All of the main banks, including ANZ, Westpac, CBA, NAB, and many smaller institutions, such as Bank of Melbourne, Macquarie, and ING, to mention a few, arrange loans.

Our top-tier status with the major banks ensures a better outcome for you, our customer.

We work with you from the beginning to establish your financial goals and ask some basic questions.

Our Services

ALIC’s staff will work with you to identify the finest financial market options to match your demands.

We have the most experienced staff at ALIC to help you discover the best solution. Whether you’re a first-time home buyer or an experienced investor refinancing to refurbish or grow your portfolio, we can help. In Australia, ALIC has access to approximately 2000 financial products. Our staff is dedicated to improving your strategy and structure and educating you along the process, giving you the confidence to increase your investments and understand your responsibilities.

Market Appraisal

No matter how much money they have or how much experience they have in the real estate market, our services are geared at finding our customers the finest available possibilities. So get in touch with us as soon as possible to find out what we can do for you. Make an appointment for a consultation as soon as possible!

Credit Assessment

ALIC can manage all of your mortgage needs, whether you need assistance purchasing a new house or negotiating the terms of an existing mortgage. Through the use of our services, the complexity of the procedure will be reduced. Contact us to learn more about how my services may assist you, and you’ll be shocked at how much simpler your life will become once we start working together.

Mortgage Lending

Mortgages and other forms of finance may be a source of significant anxiety and problems, regardless of whether you are purchasing your first house or trying to find a new investment property. Here is where I come in to play. My customers benefit from this assistance and a great deal more. So get in touch with us right now to find out more.

ARG Finance – Mortgage Broker Melbourne

1300 511 235

ARG Finance – A boutique Mortgage Broker Company with a difference!

ARG Finance is a unique boutique mortgage brokerage firm.

We are a group of highly-skilled, experienced, and financially smart experts that excel in math and can assist you with any amount or type of loan.

The proprietor of ARG Finance, Rakesh Gupta, has extensive expertise in the mortgage brokering market and has worked with a variety of lenders. Thanks to his insightful leadership and industry contacts, he has established a competent team that passes your mortgage test.

ARG Finance is more than simply a mortgage broker; it is a full-service financial solutions provider.

Services We Offer

All of the hard work is done for you!

Now is the time to start planning for your future. Allow us to assist you in finding a terrific bargain that meets your needs.

COMMERCIAL LOANS

- Business Loan

- Asset Finance

- Car Loan

- Truck Loan

- Property Development Finance

- Land Banking

- Finance for Commercial Property

HOME LOANS

- First Home Buyer Loan

- Home Loan Refinance

- Debt Consolidation

- Construction Loan

- Investment Loan

- Renovation Home Loan

- Equity Home Loan

Why Choose Us?

We are aware of how to successfully direct you through the process of obtaining a house loan or refinancing an existing one while simultaneously avoiding potential complications along the road.

- SUITABLE LOAN OPTIONS

- EASY LOAN END TO END PROCESS

- SECURE LOANS

Entry Finance – Mortgage Broker Melbourne

1300 468 234

Entry Credit is raising the bar for flexible and cost-effective mortgage and finance options in Australia.

Our ambition is to establish ourselves as Australia’s leading finance and mortgage broker. We provide creative, cost-effective, and personalised solutions to fit your needs.

Our goal is to help you achieve your financial goals while also ensuring your future. We have knowledge and skills in the fields of mortgage and loan brokerage. As a result, we may offer you financing options to help you meet your financial goals.

We believe in building long-term relationships with our customers by giving them honest and sensible options.

Our team will cut through the jargon and communicate with you in plain English, helping you to understand your options better and make the most informed financial decision possible.

We will help you through a stress-free and perfect procedure, regardless of your condition. In addition, we will keep you updated throughout the purchase process.

Services

- New Mortgages

- Refinancing Options

- Investment loans

- Equipment Finance

Why Choose Entry Finance?

In Australia, we are the finance and mortgage broker’s organization that you should come to if you want the most favourable financing options.

- Quality Finance & Mortgage Broking Advice

- Buy With Confidence

- Understanding Your Financial Goals

Melba Mortgage Broker Melbourne

0431720242

Gain access to incomparable home loan alternatives and unrivalled service in the industry.

Loan Products & Programs

We are connected to a wide network of residential and commercial lenders who, collectively, offer a full range of financial services. These lenders cater to both personal and commercial borrowers.

- There are both fixed and variable interest rates available for home loans.

- Refinance your mortgage to take advantage of the low-interest rates and the specialized benefits.

- Financing during the interim period

- Provision of funding for first-time homebuyers

- Home and property packages

- Credit Line Determined by the Market Value of the Property

Types of finance available

Clients who come to us with a wide array of needs may count on us to develop a workable solution for them.

- There are loans available for owner-occupants, in addition to loans for investors.

- clients who are independent contractors

- Providing access to professional services such as those of attorneys, doctors, and accountants

- Lending money to individuals or corporations both counts toward this total.

- Finance options for assets such as automobile loans and others

- Customers who have not paid their bills in a timely manner or who have other issues

Your Loan Assist – Mortgage Broker Melbourne

1300 007 352

You’re different.

We understand.

- Employee: Full Time, Part Time, Casual, Contractor.

- Self Employed: Full Doc, Low doc.

- It’s Complicated: Ummm… where do I start?

Your needs matter.

We make an effort.

- First Time Buyer

- Building

- Consolidating Debt

Lucid Lending – Mortgage Broker Melbourne

03 7019 2415

We are completely dedicated to assisting you in finding the house or investment property of your dreams.

Whether you’re buying your first home or an experienced property investor, we work with you as a partner to help you get the best deal possible. The process of acquiring a loan will not be stressful for you since we make it a point to ensure that you understand every aspect of your loan.

Our Services

We provide you a variety of financial choices to choose from, making it possible for you to purchase your first or subsequent property, refinance, or complete home improvements.

- First-Time Home Buyer Next Refinancing of an Existing Mortgage

- Investment Construction of New Structures and Alterations to Existing Buildings

- Commercial and Agricultural Finance and Investments

Empower Wealth – Mortgage Broker Melbourne

1300 123 724

At Empower Financial, we are firm believers that enhancing one’s wealth situation is possible and desirable for anybody who wants to pursue it. Starting with putting money aside for a down payment on your first home, buying that home and growing your wealth off of it, investing in Superannuation, figuring out how to put your family’s extra cash to the best possible use, and culminating in the creation of a multimillion-dollar property portfolio… Although it is possible, the great majority of us will want the assistance of a professional specialist.

Services

- Property Portfolio Plan

- Property Investment Advice

- Mortgage Broking

- Buyers Agents

- Financial Planning & SMSF

- Tax & Personal Accounting

- Property Research

- Money Management

So, why do our clients choose us?

- To get started, we examine their needs, goals, wishes, and personal values and the role that money and wealth will play in their lives, both now and in the future. This helps us to determine how best to serve them.

- We undertake an examination of both the current cash flow situation and the potential future cash flow situation in order to guarantee that adequate provisioning and both the current and future financial goals are met.

- We are straightforward with them about the state of their health as well as the potential results that are a direct result of the advice that we offer.

- We are in a position to fulfill the objectives of our customers by delivering a solution that is comprehensive, integrated, and tailored to their specific needs. This is made possible by the highly skilled professionals who work within each of our business divisions as well as the capabilities provided by our many business divisions. As a result, we are in a position to plot out both a short-term and a long-term path for the creation of wealth for them to pursue as a course of action.

- Our customers come to understand that it is ultimately up to them to decide what to do with their money, money for which they have put in a lot of effort and spent a lot of time; but they are aware that there is a team of experts available to guide and support them along the way.

MoneyQuest – Mortgage Broker Melbourne

1300 886 435

Regardless of whether you are looking for your first house, upgrading to fit your expanding family, or experiencing empty nest syndrome and deciding it is time to downsize, we will assist you in making an informed decision on your housing requirements. This applies whether you are looking for your first house, upgrading to fit your expanding family, or experiencing empty nest syndrome and deciding it is time to downsize. It’s just something that has to be done!

Services

- First Home Buyer

- Refinancing

- Investment Loans

- Credit Impaired

- Debt Consolidation

- Home Loan Calculators

So, why choose MoneyQuest?

Here are a few reasons.

- Free Service To You

- More Loan Options

- Local Knowledge

- Handpicked Team

- Tailored Approach

- Many Specialities

Gilbees Mortgage Planning – Mortgage Broker Melbourne

03 9633 4625

It might be frightening to make a significant purchase. However, there’s always a lot to consider when it comes to getting a loan, whether it’s for refinancing, downsizing, investing, or buying your first home. That is why it is critical to work with a professional who is familiar with the financial business and can help you discover a loan that meets your requirements and fits your lifestyle.

We wish to assist you in finding a loan that meets and exceeds your requirements in terms of rate, product, and service. We believe in providing you with choices, and we at Gilbees Mortgage Planning look forward to aiding you in fulfilling your goal of owning a home or investing in real estate. Continue reading to find out how we can help you, or go straight to our Contact Us page to get started.

Services

We take great satisfaction in providing proactive service and support to our customers. We have considerable expertise in all aspects of financing, including:

- assisting those who are purchasing their first home

- Investment Loans

- Commercial Loans

- Loans with Standard Variable Rates in Addition to Fixed Rates

- Honeymoon Loans

- Short-Term Bridge Loans

- Finance of Assets

Why Choose Us?

We differentiate ourselves from the competition by focusing on the needs of our clients in all that we do. Our guarantee to you, the borrowers, is that we will be straightforward and easy to work with.

- You will have a conversation with a genuine live person.

- We will get back to you as soon as we can.

- Every time, we shall go above and beyond what is expected of us.

- What you have to say will be taken into consideration.

- We will present you with home loan choices that are tailored to meet your requirements.

- We will search for interest rates that are competitive.

- We are dedicated to providing you with excellent service and ensuring that you are completely content with our assistance.

Own Home Loans – Mortgage Broker Melbourne

1300 721 342

Through Own House Loans, you will have access to our extensive knowledge of mortgage financing, which will make the process of obtaining the ideal home loan much simpler. But here at Own, we take things a step further by assisting you in owning not just your home but also your life and the future you choose for yourself.

We give you the tools and the assistance you need to realize your dream of becoming a homeowner sooner than you ever thought possible.

Our Own Home Loans

Why pay off your mortgage over a period of thirty years when you could accomplish it in a significantly shorter amount of time? We assist you in formulating an individualized plan to pay off your loan in a shorter amount of time. We continue to monitor your circumstances to make certain that you always have the appropriate loan. The fact that we do not charge you for our service is without a doubt the finest part of everything! Having our team by your side during the whole process of paying off your mortgage won’t set you back a dime.

- Properties Purchased by First-Time Buyers as Investments

- First Home Owner Grant

- Refinance Your Home

Own Assist Makes Moving Easier At No Cost To You!

We designed “Own Assist,” a hassle-free and cost-free service that makes it easier for you to select the right plans and services for you, save you time, reduce your stress, and cut down on the amount of work you can have to do.

Choose the services that you want, and we will assist you in becoming linked to them!

- A practical approach to the organization of your relocation

- Individual assistance at no further cost to you

- Calm and composure

- Allow us to search a variety of vendors in order to locate the greatest possible offer for you.

Because this is a gratis service, you won’t have to bother about paying for or arranging anything else!

You will even be assigned your very own Moving Specialist to assist you with every step of the process.

Lend A Loan – Mortgage Broker Melbourne

1300 861 463

Mortgage Broker | Lend A Loan Melbourne is a young Melbourne-based mortgage and finance firm with cutting-edge technologies that assists each of our experienced mortgage brokers in finding the best solution for our valued clients.

Our Melbourne mortgage brokers can help their customers with their lending needs, whether it’s a home loan, a business loan, a commercial loan, car finance, refinancing, or debt consolidation. Every member of our mortgage broking staff is driven, knowledgeable, and adds something special to our financial firm.

Every day at our Melbourne office, our enthusiastic and devoted finance and mortgage brokers come together with a few similar aims and values: to provide the finest financial solutions to our valued customers while keeping their best interests in mind.

Lend A Loan Finance, and Mortgage Brokers offer access to over 45 residential and commercial banks and lenders, allowing them to help you choose the best loan solution for your specific financial needs.

Our Melbourne Mortgage Broker staff may meet with you at your home, at your place of work, or at one of our Melbourne locations. To begin your adventure of choosing the correct loan and comparing thousands of loan packages with our skilled Melbourne mortgage brokers in just one session.

Our Finance And Mortgage Broking Services

We provide a range of finance and mortgage broking services.

- Home Loans

- Commercial Loans

- Business Loans

- First Home Buyers

Why Choose A Lend A Loan Mortgage Broker

Give Someone A Loan Mortgage Brokers always keep their clients’ best interests in mind while making decisions. We will only propose items to our customers that meet the budgetary needs they have expressed to us.

- Operational Excellence

- Wide Range Of Loans

- Flexible Appointments

- Trained Specialists

- Accredited Organization

- At No Expense To You

Lending Specialists – Mortgage Broker Melbourne

03 9764 2646

The Lending Specialists advantage:

- Our company has been around for a very long time, and we have a lot of expertise under our belts.

- Our team and brokers have years of industry expertise, and we have a successful track record.

- Our principles include being courteous, honest, supportive, professional, and tolerant. As a result, we get things done (even the difficult transactions). Making things happen is an achievement that we attain on a daily basis.

- We have hundreds of connections in the industry. We have a large variety of commercial, banking, and financial talents. We are skilled negotiators. Our diversity enables us to solve difficult problems and create rational answers.

- We are adaptable and always thinking one step ahead.

- The sum of all of our employees’ prior experience is substantial.

- We have extensive, in-depth knowledge of your immediate neighbourhood.

Products

Lending Specialists provides access to a variety of loans and choices that may be adapted to meet the requirements of individual borrowers. The following are some of them however the list is not exhaustive:

- Finance for Homes and Other Investments Home Loans

- Loans for Self-Administered Superannuation Funds

- Loans for businesses and commercial enterprises

- Finance for Motor Vehicles and Other Equipment Finance

Guidance Mortgage Brokers Melbourne

guidancemortgagebrokers.com.au

0405 447 241

Guidance Mortgage Brokers is an amazing credit consultancy that can assist you with all of your residential and business financial requirements by providing real service, a variety of options, and sound guidance.

Why Guidance?

- We have access to a big pool of lending institutions, which includes all of the main banks.

- We take care of all of the complicated paperwork for you, from the application to the settlement.

- We give detailed explanations of all of the fees, charges, and processes involved with the loans.

- Throughout the entirety of the loan process, we place a premium on providing exceptional service to our customers.

How Can We Help?

- Buying A Home

- Becoming A First Home Buyer

- Building A New Home

- Refinancing Your Home Loan

- Investing In Property

Why should you use a mortgage broker?

More than half of all Australians now get their house loans through a broker, and there are a lot of positive reasons for this trend. However, the fact that we work for you and not the banks is perhaps the most significant advantage we provide. First, we have a conversation with you to learn about your requirements, and then we put our expertise in the market to use by negotiating with the lending institutions. After that, we will obtain a number of possibilities before determining which one is best for you rather than what the lenders consider to be in their best interest.

Sprint Finance – Mortgage Broker Melbourne

1300 547 252

Purchasing a home is likely to be one of the most significant purchases you will make in your life. However, if you’re a first-time home buyer, the process might be intimidating and perplexing. As a result, you shouldn’t trust it to just any Mortgage Broker or Lending Specialist.

Sprint Finance is a mortgage broking firm that is entirely owned and run by Australians. While we work with some of the country’s largest lenders, finding the proper loans and lenders for you is our first focus. We’re committed to helping you discover a mortgage that allows you to adapt to anything life throws at you.

Purchasing a home should be a thrilling experience for you. You’ve put in a lot of effort to get to this point. Now is the moment to purchase your dream house. Our knowledgeable staff will make the process of obtaining a home loan as simple as possible. We’ll be there to help you every step of the way. Our Finance Specialists are accessible to answer your queries regarding mortgages and loans seven days a week.

Service

- How to invest in property using equity

- Private mortgage finance

- Commercial lending

- SMSF refinancing

- SMSF lending

- Residential asset finance

Why choose us?

- Keeping it simple

- Experienced

- Fast service

- Talk online

Vanquish Finance Group – Mortgage Broker Melbourne

0409 089 241

They started their business in 2005, and since then, they have arranged thousands of home loans for thousands of customers. These customers include people who are buying their first home, people who want to refinance their existing home loan, and property investors who are entering the investment market for the first, second, or third time.

We are dedicated to becoming active members of the community that we call home. Accordingly, we emphasise the utilization of technology to lessen our carbon footprint and the development of sustainable and well-balanced decisions that promote the achievement of favourable social, economic, and environmental results.

Our Service

- Calculate Stamp Duty

- Loan Repayment Calculator

- Borrowing Power Calculator

- Budget Planner

Government Grants & Schemes

- First Home Owner Grant

- First Home Loan Deposit Scheme

- Family Home Guarantee

- New Home Guarantee

My Expert – Mortgage Broker Melbourne

1300 693 363

Making critical financial decisions may be difficult, and emotions and stress levels can – and do – run high, as we know from our more than 20 years in the home loan and banking sector.

Our company was formed to remove the emotional stress from real estate transactions and boost community welfare by providing industry-leading assistance and guidance that our clients can rely on. It’s a principle we still follow today, and it’s one of the reasons we’re one of Australia’s top home loan brokers.

Expert advise on the most crucial financial decisions you’ll ever make.

Expert knowledge and insight are required to make sound financial judgments. We recognize that, as individuals, we require financial guidance and solutions tailored to our personal needs.

As a result, we have three specialized departments offering expert customised advice on house loans, conveyancing, financial planning, and risk insurance.

Services

- Finance

- Conveyancing

- Wealth

Why choose My Expert?

- Award-winning financial advisors

- Experienced and trusted advice

- Passionate and professional team

- Excellent customer service

Market Street Finance – Mortgage Broker Melbourne

1300 612 253

With all of our clients, we work closely and thoroughly.

For businesses, this involves taking the time to learn about their operations from a financial and planning standpoint. This allows us to understand existing pain spots better and identify areas where we can assist with growth.

Individually, we consider not just present finance needs but also long-term objectives. This guarantees that whatever money we put in place now and in the future is suitable.

We conduct an annual evaluation of all loan facilities for firms and people to verify that they are remain competitive and acceptable.

Services

- Commercial Finance

- Business Finance

- Development Finance

- Home Loans

- Equipment Finance

- Energy Finance

Axton Finance – Mortgage Broker Melbourne

03 9939 2363

Axton Finance is your team of industry professionals who will find and offer the finest industry choices for your specific need. Our experienced staff will take the time to get to know you, develop a connection with you, and analyze your financial situation and aspirations to provide the finest solution that is completely suited to you.

We do all of the legwork for you to discover the greatest solution product on the market. There are a plethora of banks and financial institutions out there offering various rates, terms and conditions, fee schedules, rewards, and penalties, and weighing them all to discover the best selection is a difficult task. We match your circumstances and aspirations to the best goods on the market, brokering the entire process and making it as simple as possible for you.

Specialist mortgage services for a range of goals

Every day, as top mortgage financing professionals, we assist Australians in finding their ideal house or investment property. Apart from residential loans, we also provide private banking, construction finance, refinancing, and expat lending.

We take pleasure in providing tailored solutions to all of our clients, and we can help you with any of your requirements. So, whatever your objective is, talk to our team of experts, and we’ll put up a custom package to help you reach it faster.

Fast approvals & expert help when you need a loan specialist

We can move quickly to match you to a solution that is right for you, saving you valuable time and helping you to ensure that you secure the property you are after. As mortgage brokers in Melbourne, we have decades of industry experience, so we can move quickly to match you to a solution that is right for you.

Get access to the best rates from leading bodies.

Our links to a diverse group of banks and lenders allow us to provide you with access to over 25 distinct lenders who together provide hundreds of different products. As a result, a product may be provided that will fulfil all of your requirements. We will exhaust every possible avenue in our search for the optimal solution. We will collaborate with the bank and other lending institutions to develop a product that is specifically tailored to your requirements to make the accomplishment of your objectives simpler and more expedient.

Give our team a call now if you would like more information on how Axton Finance may assist you in achieving your objectives.

Alecto Finance – Mortgage Broker Melbourne

0403 335 235

The multi-award-winning staff at Alecto Finance, which has its headquarters in Melbourne, is able to assist you in locating a loan that is specifically suited to meet your requirements. The team has a combined expertise of over 50 years in aiding customers with the purchase of a car, a piece of equipment to set up your office or practice, as well as the acquisition of a residential or commercial property. This includes negotiating the best possible price for the client.

Busy Professionals

- Asset Finance

- Home Loans

- Commercial Loans

- Business Loans

Trusted Mortgage Broker Melbourne

0425 792 325

“In all of my transactions with you, I have your best interests in mind. By doing so, I will make sure that the loan I offer to you is appropriate (in terms of amount and structure), is affordable, is applied for in a compliant manner, and achieves your set of objectives at the time that you are seeking the loan.

Since we are serious about running our company, we take great delight in providing long-term support for our customers.

- Our focus is on our clients, and we pride ourselves on our basic beliefs

- Our customers are important to us, and we appreciate them.

- We have a bright outlook and an upbeat attitude.

- Our primary focus is on the satisfaction of our customers, and we will take the time to learn about YOU.

- Our one-on-one service is unparalleled in quality and effectiveness.

- We conduct ourselves in a manner that reflects professionalism, honesty, and integrity.

- We commit to providing a service founded on honesty and a genuine desire to serve our customers’ best interests by meeting all of their financial requirements via the utilization of our available resources in the form of financial and insurance products.

We don’t merely vanish when your loan repayment has been completed! We are still here to respond to any queries you may have and to keep you informed about the latest developments in the home loan and real estate markets.

Services

- Guarantor Home Loans

- Business Loans

- 10% Deposit Home Loans

- Refinance Home Loan

- 5% Deposit Home Loans

- Low Doc Home Loan

- First Home Buyer Home Loan

- Commercial Loans

- Investment loans

- Personal loans

- Self-Employed Home Loan

- Fixed-Rate Home Loans

- Insurance

- Info Sessions

Why Choose Us?

As seasoned mortgage brokers, we realize how perplexing the process may be, especially for first-time home purchasers in Melbourne. It can be difficult to sort through the many loan criteria, the shifting awards and bonuses, and the convoluted vocabulary and fine print.

When you entrust this procedure to us, we will bring our years of knowledge and our extensive network of connections to bear on the task, allowing you to select the ideal product without having to go through the difficulty yourself. This saves you time and lowers your chances of getting turned down because we already know which lenders’ credit policies and limits will work for you.

Our Melbourne mortgage broker can also help you save money by negotiating reductions and teaching you on how to use home loan options to pay the bank less interest. And we back it up with thorough service that lasts from the moment you contact us until the day your loan is paid off.

Soren Financial Mortgage Broker Melbourne

1300 899 819

Lenders and brokers will constantly strive to sell you the simplest and most expedient product possible. Unfortunately, although it is their bread and butter, it is not always the best option. There are many unique goods available that experienced investors are aware of but that the average public is unaware of, and the main explanation for this is a lack of awareness/education. Isn’t it crazy?

Many beneficial developments have occurred as a result of the recent financial sector shakeup in 2019, but there has also been a flat structure when it comes to mortgage broker payments. This means for you as a client that your broker is paid the same regardless of what they provide, resulting in the “Vanilla Effect.” As a result, a broker has no immediate financial incentive to go further into your specific situation and try to match you with the best product and lender. Instead, you’ll be steered toward a lender that the broker is familiar with most of the time.

I understand the difference between a lousy and an excellent broker because I’ve dealt with both. As a result, I’ve developed a brokerage experience on what I anticipate as a customer. We want to establish long-term connections with you and link you with expert consultants from a variety of industries that will make your purchase as painless as possible. We have built our business on recommendations from existing clients and will continue to do so. We look forward to partnering with you to find the correct product for you and make your next purchase as stress-free as possible.

We can put you in touch with professionals that can assist you with the full purchasing process. The following services are included: Conveyancers, Tax Agents, Real Estate Advisors, and Independent Valuers are all examples of professionals that work in the real estate industry.

Build your Legacy with Soren Financial.

Whether you are a first-time buyer looking to navigate the available grants or a professional investor looking to make a purchase via your self-managed super fund or family trust, we have specialized services to help clients through every stage of the buying process. These services are available to both first-time buyers and investors.

Services

First Home/Investment Purchase

We will provide you with recommendations for the goods and lenders that are the most suitable for your individual circumstances, regardless of whether you are a first-time buyer or an experienced investor. You can expect to receive consistent updates from our staff on a regular basis, and we will work closely with your advisers (accountants, attorneys, real estate agents, and conveyancers) to ensure that everything is proceeding in the desired direction.

Self Employed/Business Owners

One of the services that we specialize in is making sure that you have the appropriate documentation and are able to get your approval on the first try. Traditionally, owners of businesses have to jump through more hoops in order to get their financing deal approved. Although many lenders offer products to you, we want to make sure that you have everything you need in order to do so. You will be given an information sheet to fill out, and we will work to match your expectations with the appropriate lender as well as the product that is most suitable for you in light of your circumstances.

Developer Finance

In an era when lenders are wary of risk, your project must be a strong one with a proven track record. Please contact us to discuss your project and the many items available.

Business Financing for the Short Term

Short-term business loans might help your company get the financial flow it needs, especially during these trying times. One of the key advantages is that short-term company loans are typically obtained from non-bank lenders, making them significantly easier to get and allow for a much shorter turnaround time.

Asset Finance

Through the use of asset financing, a company may have access to a variety of commercial assets, including equipment, machinery, and cars, without having to invest or lock up their own corporate money. You may also be able to free up cash that is locked up in the value of assets that you already possess, or you may be able to utilize your current assets as collateral for a company loan obtained from an asset financing lender. As a result, we have access to a diverse selection of goods that will fulfill your company’s requirements.

Construction Loans

A construction home loan is a form of house loan that is meant for persons who are constructing a home or making extensive improvements rather than purchasing an existing home. It has a different financing structure than home loans for customers who want to buy a house that is already built.

A progressive drawdown is the most prevalent feature of a construction loan. That is, rather than receiving the entire loan amount at once, you receive it in installments during the building process. In addition, rather than paying interest on the whole loan, you usually just pay interest on the amount pulled down.

Bspoke Mortgage Broker Melbourne

1300 386 630

Even in the best of circumstances, financial decisions are tough to make. These choices are considerably more difficult when you don’t know where to begin or who to trust.

We listen to learn about your unique circumstance so that we may offer ideas and alternatives that are right for you.

At the heart of what we do is guiding you through the process and explaining the “why.” We aim to educate, assist and support you so that you may make the greatest financial decisions possible, not only today but in the future.

We treat each application as if it were our own, and we want the best for you because we care.

We think that financial decisions are a journey, not just a moment in time. So we wish to accompany you on your journey today, tomorrow, and in the future.

Our Purpose

We are well aware that each person is unique. Nobody is exactly like anybody else, and no two situations are ever exactly the same.

Whether it’s the purchase of your first home, an expansion of your investment portfolio, the refinancing of your commercial premises, the consolidation of your existing debts, or the acquisition of a vehicle for personal or commercial use, we’ll work with you to develop a solution that is uniquely suited to your needs.

We will be there for you every step, illuminating the murky waters ahead of you and lending you our support as you navigate each procedure.

Clark Finance Group – Mortgage Broker Melbourne

1300 366 670

Clark Finance Group was established to simplify the home loan process for our customers and assist them in locating the most suitable mortgage option to meet their individual requirements.

We do not simply give loans; rather, in addition to our accreditations with over 35 lenders, including all of the main banks and financial institutions, and our access to over 600 various financial products, we provide individualized financing solutions.

Our Mission

Our mission is to provide our customers a wider range of options, excellent deals, open and honest counsel, and personalized service in the time-honoured tradition.

We do not feel that the completion of our service, which is the settlement of your debt, marks the end of our partnership but rather the beginning. We hope to earn your trust and become your lifetime financial specialists by empathizing with your priorities and accelerating your progress toward achieving your objectives.

Industry Leaders

Mortgage and Finance Association of Australia (MFAA) is the peak industry association in Australia, and Clark Finance Group is a Full Member and Approved Mortgage Broker of the MFAA. The MFAA is responsible for providing its members with a code of conduct as well as ongoing professional development opportunities. When you get in touch with us, you can count on getting the absolute finest product and service possible since we make it a point to stay current on all of the most recent advancements and breakthroughs in the financial industry.

Expertise That Goes Beyond The Numbers

We do not feel that the completion of our service, which is the settlement of your debt, marks the end of our partnership but rather the beginning. We want to see the world the way you do and assist you in achieving your monetary objectives more quickly.

Our Approach

What sets us apart from the competition is that we consider things from the client’s point of view and offer a financial solution centred on securing the appropriate financing and the appropriate result in light of what you require both now and in the foreseeable future.

The Process

We will walk you through the whole process of purchasing a house, present you with up-to-date information on various property markets, respond to each of your inquiries, and offer considerate and thoughtful guidance specifically customized to your requirements.

Your Experience

We are driven by finding solutions that are in the best interest of our customers. Our mission is to earn your confidence as a reliable resource so that we can assist you in accomplishing your long-term objectives. Providing honest guidance that is supported by personalized service in the time-honoured tradition.

Entourage Mortgage Broker Melbourne

03 9421 1651

Who we are