Accounting is one of those things that every company, no matter how big or how small, needs to have.

Many times, businesses are required to spend a significant amount of money on the accounting department. When it comes to satisfying their accounting requirements, a company has a number of options available to them to choose from. It is in the best interest of your company to consider all of the available alternatives and select the one that will result in the greatest number of positive outcomes at the lowest possible financial outlay.

Employing the services of an accounting firm is among the most typical choices made by individuals. The accounting firms take care of all of the business’s tax and accounting obligations, which frees you up to concentrate on other critical duties that contribute to the growth of your company and helps you make more money.

Are you wanting to start a business in the Melbourne, Victoria area and searching for a qualified accountant? Personal selection of each and every accountant is one of the greatest methods to make sure that your ideal business turns out just how you imagined it would, and this is one of the best ways to do so. In this way, you will be able to construct the ideal small business for yourself by selecting the ideal location, the greatest services, and the like.

To help you save time and money, we have compiled an exhaustive list of businesses that provide accounting services.

The Ultimate List of Melbourne’s Business Accountants

Bookkept – Business Accountants Melbourne

(03) 8568 3606

Bookkept, a team of CPA-qualified accountants based in Melbourne, specializes in offering top-tier accounting and business advisory services to small and medium-sized businesses across Australia. With expertise in platforms like Xero and MYOB, they manage compliance, bookkeeping, ATO-related challenges, and payroll. Their end-to-end service ensures seamless integration between bookkeeping and accounting, eliminating any potential gaps.

The firm’s founders, Daniel and Brendan, envisioned a progressive approach to accounting, moving away from traditional practices and overheads that often burden clients. Instead, they emphasize transparency in their fee structure, charging for the value of the service rather than time. Beyond just accounting, Bookkept provides clients with insights into their financial reports, enabling them to strategize for growth and seize bigger opportunities.

They maintain regular communication with clients, ensuring timely tax management. Their “future-proofing” approach offers guidance on tax planning and asset protection. Committed to innovation, they utilize cloud-based solutions for a holistic view of business performance, operating in a completely paperless environment. Their adaptability and problem-solving prowess set them apart, empowering clients to achieve their business aspirations.

EWM Accountants & Business Advisors in Melbourne

03 9568 5444

EWM Accountants and Business Advisors, located in Oakleigh, Melbourne, comprise a team of Chartered Accountants dedicated to supporting small businesses across various sectors, including construction, investment, medical, dentistry, and manufacturing. With over 30 years of experience, they offer tailored solutions, recognizing that each business has unique needs and preferences, whether it’s digital communication through platforms like Dropbox® or traditional mail correspondence.

Their services extend beyond traditional accounting, offering comprehensive support in bookkeeping, payroll, and financial advising. They specialize in relieving the burden of financial management from their clients, enabling businesses to focus on growth and expansion. Regular consultations are a part of their commitment, ensuring customized advice and information relevant to each client’s situation.

EWM places a significant emphasis on client growth, navigating complex compliance requirements with a team of skilled professionals adept in up-to-date financial management practices. They offer flexible solutions, including fixed-price agreements, catering to businesses at various stages. Their approach is proactive, offering advice when needed, not just when asked, and building personalized relationships for more tailored service.

Their end-to-end service ensures seamless integration between various financial aspects, preventing any oversight or gaps. From managing comprehensive tax accounting to strategic advice, asset protection, estate planning, and effective tax preparation, EWM stands out as a versatile partner for any business. They pledge to create service processes that align perfectly with client needs, ensuring no generic solutions, but rather detailed, client-specific strategies.

Hillyer Riches Business Accountants in Melbourne

(03) 9571 5333

Hillyer Riches, based in Caulfield East, is a team of dedicated chartered accountants, tax specialists, and business advisors with over 30 years of experience. They specialize in offering comprehensive tax, accounting, and business advisory services tailored to both individuals and businesses. Their expertise spans from basic tax accounting and planning, including BAS and IAS obligations, to advanced strategies for business growth, cash flow management, and asset protection.

Understanding the importance of efficient and accurate accounting, Hillyer Riches emphasizes reducing the compliance burden for their clients. Their team is adept at utilizing cloud accounting systems, partnering with platforms like MYOB, Quickbooks, and XERO to ensure clients have the best technological solutions tailored to their needs. Beyond just numbers, they believe in assisting clients in managing their business performance, turning ideas into actionable strategies.

Having successfully run their own business for three decades, the team at Hillyer Riches offers practical advice grounded in real-world experience. They pride themselves on being proactive, understanding clients’ unique needs and goals, and offering continuous support throughout the year. Their expertise extends to helping clients navigate the complexities of tax and regulatory requirements, ensuring smooth business operations without the stress of potential pitfalls.

For those seeking a team of accountants who prioritize genuine outcomes and a hands-on approach, Hillyer Riches stands out as a reliable partner. They invite potential clients for a free consultation to explore how their expertise can benefit their business endeavors.

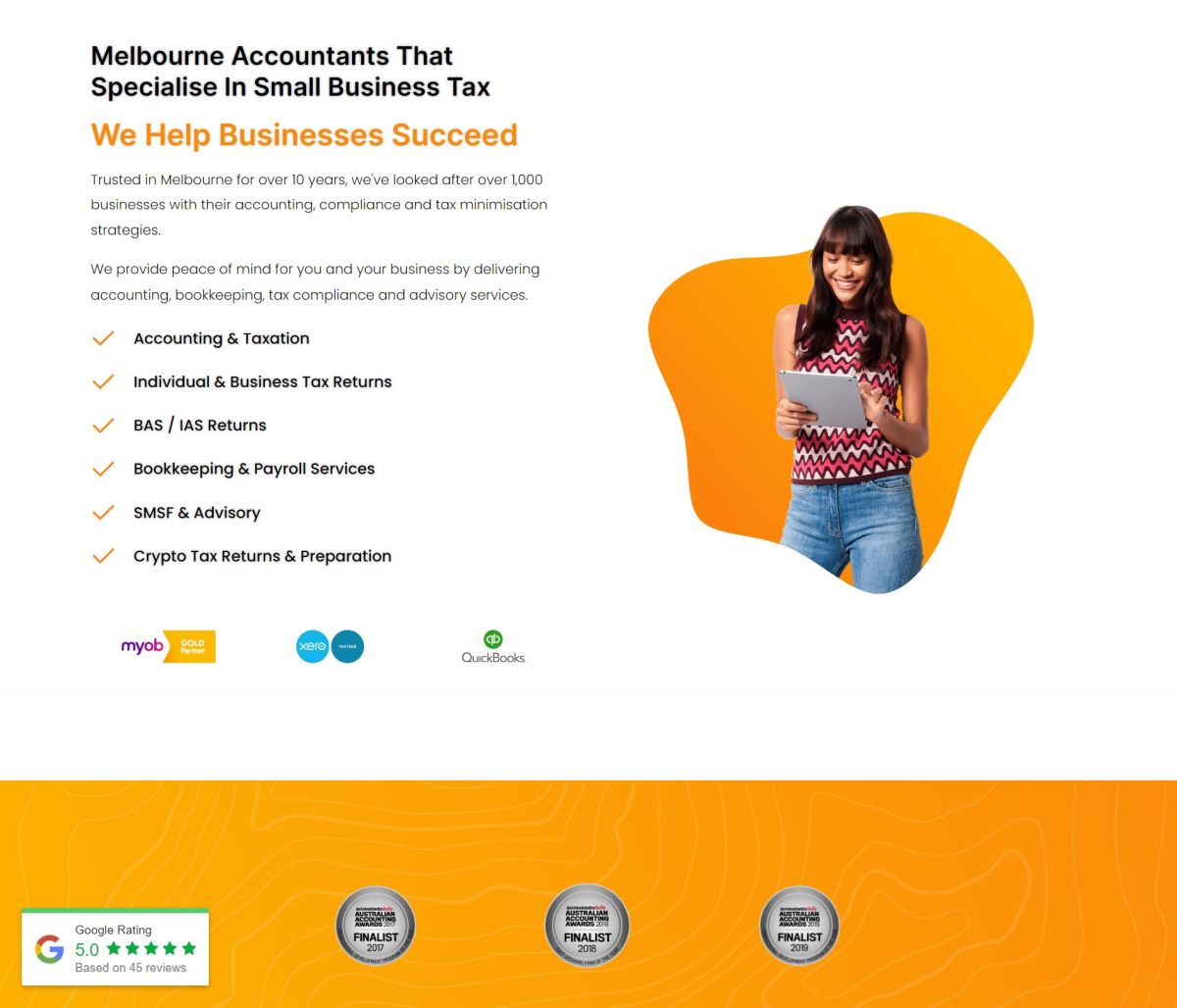

Tax Window

Located in Melbourne, Tax Window is a respected accounting firm committed to assisting individuals and businesses in achieving their financial goals. Through a strategic approach, the company turns clients’ aspirations into achievable objectives. With a significant 30-year history, Tax Window sets itself apart by having senior accountants, not juniors, manage client affairs. The firm underscores its transparent pricing model, emphasizing that, despite their accounting expertise, their fees deviate from conventional accounting standards.

Services Offered:

- Tax Agent Services

- Small Business Accounting

- Specialized services for various industries including cafes, franchises, tradies, builders, bars, medical practitioners, startups, plumbers, and restaurants.

- Investment Planning

- Business Advisory

- Property Consultation

- Advice on SMSF (Self Managed Super Fund)

Contact Details:

Website: https://www.taxwindow.com.au/

Address: Level 1/441 South Rd, Bentleigh VIC 3204

Operating Hours: Mon-Sun 9:00-18:00 (By Appointment)

Phone: 03 9999 8538

Email: [email protected]

MAS Tax Accountants – Business Accountants Melbourne

1300 627 820

MAS Tax Accountants, situated in Melbourne’s Chinatown, is a premier accounting firm dedicated to delivering tailored tax, accounting, and business solutions. With a special focus on serving cafés, restaurants, IT professionals, and Family Day Care centres, they offer a comprehensive suite of services, from individual tax returns and business planning to bookkeeping and software training. Their experienced team, backed by proficient administrative staff, ensures that clients receive top-notch advice and support. Whether you’re an individual, a budding entrepreneur, or an established business, MAS Tax Accountants stands ready to guide you with their expertise and client-centric approach.

Chan & Naylor Melbourne – Business Accountants Melbourne

03 9888 3176

Welcome to Chan & Naylor Melbourne

Chan & Naylor Melbourne seeks to provide the highest level of service to its clients at all times and to position itself at the forefront of Business Advisory Services within the Accountancy Industry.

Property Tax Accounting

Our professional property tax accountants at Chan & Naylor Melbourne are known for providing dependable tax guidance and property tax accounting services to property investors. With the support of Chan & Naylor Melbourne, investors at all phases of the property investment journey, whether starting out or well established, can:

- Structure your investment portfolio for better asset protection.

- Improve cash flows of your property portfolio by deducting various depreciation expenses.

- Property investment strategies that can legally reduce taxes.

- Claim all tax deductions that you are legally entitled to, including all depreciations and expenses related to improving, managing and holding your investment property.

- Access ultra-low interest investor loans through our Finance team.

- Structure your debt to purchase investment properties.

- Develop strategies to fund and structure-property purchases.

Indus Accountants – Business Accountants Melbourne

1300 659 899

With over 15 years of combined experience, we are a team of Certified Public Accountants, Registered Tax Agents, ASIC Registered Agents, and Mortgage Brokers that are conveniently located in all major Australian cities to serve the on-site and off-site accounting needs of clients from all walks of life.

We provide services in tax, accounting and bookkeeping, SMSFs, business structuring, and strategy.

Uplift Accounting – Business Accountants Melbourne

03 8510 7524

Uplift Your Bottom Line

We can help you with your business accounting needs in Melbourne today!

Accounting & Tax Services in Melbourne

Top Accountants and Tax Agents in Melbourne keep things simple for you and help you flourish.

We take pride in dull accounting that allows you to see the big picture.

There’s more to value than numbers.

Top Melbourne accountants and tax agents provide real-world accounting and tax advice.

With the support of a skilled team of Melbourne accountants and tax agents, create seamless accounting solutions that help you manage and expand your business!

Our Melbourne accountants and tax advisors may assist you in developing a personalised accounting solution that meets your budget and business requirements. Uplift’s customised business accounting and tax services are perfect for every company at any level of development.

The relationships we develop with each of our clients and partners are Uplift’s strength.

Please be honest with us about your expectations and budget.

Our consistent development speaks for itself.

MC Business Advisors – Business Accountants Melbourne

0415111293

The most trusted family business consultant team around you

We only serve one type of customer: family businesses.

We have more than ten years of experience working in an Australian accounting firm.

The top four accounting firms in the world and the top ten accounting firms in the world are among them.

The Australian Institute of Tax Accountants has appointed our head accountant as a senior member.

Worked for the Big Four accounting companies as a senior tax consultant and senior manager.

Tax consulting

A family business’s typical family structure is more convoluted, and the tax obligations are also more stringent.

The Australian taxation system is also extremely intricate. For family consumers, providing timely and essential tax advisory services is a must.

Our organisation also has to provide dependable international tax law support to consumers because of their background.

We have provided tax group formation and integration services, trust fund formation and restructuring services, family asset structuring services, and tax audit on behalf of clients in recent years.

Etax Local Accountants – Business Accountants Melbourne

1300 174 680

As a small business, you need to know your tax and accounting are looked after.

Business Services

Complete accounting and financial support for solo proprietors and other owners of small businesses

Are you a lone trader or owner of a small business? Do you spend too much time worrying about your company’s finances?

When it comes to the management of a company, time is an extremely valuable asset. Because of this, there are never enough hours throughout the day to properly attend to customers, supervise employees, locate and contact vendors, and cultivate new business. When you include in the need to monitor the financial status of your company, it’s easy to feel as though you’re working around the clock.

Accountant Melbourne Co – Business Accountants

1300 629 455

Our Accountant Melbourne Co office serves all of Melbourne, or we can come to you!

Melbourne accountants provide professional accounting and tax guidance at reasonable rates.

Accounting Services we offer!

All of our clients receive practical and tax-effective accounting and financial solutions.

Services

Accounting, bookkeeping, and payroll services are provided by Accountant Melbourne Co to businesses, individuals, and other organisations.

Taxation

Your tax return (business, trust, partnership, sole superannuation trader, individual) can be lodged electronically* by Accountants Melbourne.

Integrated Accountants Financial Planning – Business Accountants Melbourne

1300 468 221

We help people just like you achieve everyday independence at Integrated accountants financial planning. We provide a financial framework that goes beyond the numbers to establish the aims and values that actually represent the real you. We are part mentor, part coach.

We look at what motivates you and your goals.

Where you are now and where you want to be in the future.

Not only what you require, but what you desire.

What you want to say and how you want to be remembered are the most important things.

We’re qualified and skilled in the technical aspects of financial guidance as your financial planners, but what we really care about is your broad picture and how to activate the life you want to live today and tomorrow.

What We Do

Smart Business Advisors – Accountants Melbourne

(03) 9067 7793

Welcome to Smart Business Advisors

The accountants and consultants at Smart Business Advisors have been present since the beginning to change the entire game plan and help your business run better and easier than ever before. Our first aim is to improve your chances of success. We have extensive experience in financial accounting, bookkeeping, financial management, and strategic business and commercial consulting to help you expand your company to new heights. We have a proactive and experienced team of accountants who will give you with the finest outcomes possible.

Tsiaras & Co – Business Accountants Melbourne

(03) 9484 0567

MELBOURNE ACCOUNTANTS WITH OVER 25 YEARS OF EXPERIENCE

When you hire Tsiaras & Co as your accountants in Melbourne, you’ll get the technical experience and skill that you’d expect from a professional accounting business. Our knowledgeable and experienced advisors take a proactive approach to your small business accounting and financial planning needs, and we take pleasure in providing fast, high-quality service that helps your company grow.

Mr. Taxman – Business Accountants Melbourne

1800 829 629

Mr Taxman, aka Adrian Raftery, PhD, MBA, B.Bus, CPA, CTA, FCA, F Fin, FIPA FFA

The book “101 Ways to Save Money on Your Taxes – Legally!” written by Dr. Adrian Raftery, often known as “Mr. Taxman,” is a runaway best-seller. (currently in its 10th edition) and is regularly consulted by the media on subjects pertaining to taxation, retirement, and finances. In addition to a Graduate Diploma in Financial Planning and a Graduate Certificate in Journalism, Adrian possesses a Master of Business Administration and a Doctor of Philosophy in the field of Self-Managed Superannuation Funds. He is an expert in providing business consulting services, accounting services, retirement planning, and tax planning.

PMCA Business Advisors & Accounting Melbourne

1300 744 544

There’s nothing small about your business

In both your and our lives, your small business is extremely important.

Make PMCA a part of your team to help you build a better, more profitable company.

Accountants Melbourne

Many businesses have difficulty resolving their financial and management problems. Sometimes all you need is a qualified set of eyes who can apply years of experience to your specific circumstance.

Turn confusion into clarity with PMCA

Don’t let worries about your finances keep you awake at night. See how much better you feel after speaking with PMCA for the first time.

AIM S Australia – Business Accountants Melbourne

1300 112 461

Your Tax Return Your Way With AIM S Australia

At AIM S Australia, we strive to understand each of our clients’ needs and aspirations in order to deliver the finest solution for your company’s growth and profit.

Our dynamic team of highly skilled and dedicated Melbourne accountants, auditors, and bookkeepers combines decades of expertise with new, innovative ideas.

Galley Associates – Business Accountants Melbourne

0433 482 120

Galley Associates is dedicated to assisting you in developing and pursuing the strategies required to build, maintain, and defend your company’s and personal wealth and prosperity. Our goal is to give you with good, rational, and personalised financial solutions by carefully analysing your financial requirements in a courteous, knowledgeable, and professional manner.

Our first focus is to learn about you, your priorities, and your goals. It’s not about a one-time service for our clients; it’s about long-term financial goals and long-term preparation. We recognise that everyone’s financial situation is unique, and that the economic landscape changes on a daily basis, but we will work hard to keep up with you.

Abound Business Accountants Melbourne

(03) 9071 4009

ACHIEVE YOUR BUSINESS & FINANCIAL GOALS

We go beyond the number crunching.

Business Services

In any business, the first step is to get it correctly the first time.

Our knowledgeable team already knows what’s needed; it’s what we do.

We can help you:

- Make a decision regarding the legal form that will best serve your firm: sole proprietorship, partnership, or limited liability company.

- Organise a plan of action for your company, including cash flow estimates, budgets, and trade forecasts.

- We will evaluate your financial needs, provide recommendations on where the greatest opportunities for funding can be found, and draught the relevant bids.

- Develop a productive working connection with your financial institution.

- Create a marketing plan that is flexible and easy to put into action.

By assisting you in the following areas, we also make certain that your company operates on a solid procedural foundation:

- Finish the registration process with both the ATO and the ASIC.

- Take care of dealing with the ATO on your behalf here.

- Establish a recording system for your company’s use as well as to satisfy the regulations imposed by the government.

- Take care of any and all additional company secretarial concerns that may crop up.

- You should be directed to other organisations that can help you with other areas as needed, such as Information Technology and Digital Solutions. These organisations should be able to assist you.

MDB Taxation and Business Advisors – Business Accountants Melbourne

03 9349 1483

Since 1997, MDB Taxation & Business Advisors has a proven track record of achieving positive results for its many clients.

MDB provides accounting and management services to major private enterprises and ASX-listed corporations, but it is also proud of its capacity to bring big business experience to smaller organisations and people.

FRANK PETRUZZELLI, Principal Partner at MDB, has one mission:

“To help all MDB clients sleep well at night.”

Frank specialises in tax planning and asset protection, and he has established a strong and skilled team of 20 people around him, making MDB one of a rare breed of accounting firms that can provide services on pace with the largest firms while still giving your business the personal attention it deserves. Frank has a Bachelor of Business Administration (Accounting) degree and is a member of the following professional organisations:

- Fellow Member of the Institute of Public Accountants (IPA)

- Fellow Member of National Tax and Accountants Association (NTAA)

- Tax Agent

Frank also sits on the Board of the following ASX listed companies:

- Solimar Energy Limited (ASX Code SGY) Chairman. This company is an oil and gas explorer in California USA

- Golden Gate Petroleum Ltd (ASX Code GGP) Director. This company is an oil and gas explorer in Texas and Louisiana USA

- Also a former director of Orchard Petroleum Ltd which was taken over by a Hong Kong Company in 2006

Please look over our services or contact us today to learn more about how MDB may assist you.

Since 1997, MDB Taxation & Business Advisors has a proven track record of achieving positive results for its many clients.

MDB provides accounting and management services to major private enterprises and ASX-listed corporations, but it is also proud of its capacity to bring big business experience to smaller organisations and people.

Please go over our service menu on the right or contact us now to learn more about how MDB may assist you.

Nobel Thomas Business Accountants Melbourne

03 8679 6551

We’re A Full-Service Melbourne Business Accounting Firm

Mert and his current Nobel Thomas team have successfully created an outstanding reputation as one of Melbourne’s best accounting businesses for over 20 years. Working with small, medium, and big enterprises, as well as huge franchise chains, is our main focus. Property investment and construction are also areas where we excel.

We provide a full range of professional and experienced accounting services to businesses of all sizes and in a variety of sectors. We are well-equipped to deliver a customised solution based on your unique needs and problems.

eFirm Accountants – Business Accountants Melbourne

03 9034 7127

Our clients receive tailored professional services from eFirm in Melbourne. Our team has a broad understanding of taxation and the business environment. We’ll be happy to assist you whenever you need it.

HID Group – Business Accountants Melbourne

03 9341 7338

Do you need a clear strategy to help your company grow?

HID Group is a firm of qualified accountants and business advisors.

Our Business Growth System is an all-in-one solution for getting your company back on track.

Accounting Services

Expertise includes, and not limited to, the following:

- Preparation of Statutory Financial Statements for Individuals, Companies, Trusts and Partnership

- Preparation of Statutory Financial Statements, Member Reports and all relevant documentation for Self-Managed Superannuation Fund

- Preparation of Interim Financial Statements

- Preparation of Periodical Management Reports

- Real-Time Bookkeeping Solutions for your business including data entry, accounts receivable, accounts payable, payroll services, superannuation, PRT and WorkCover

What is the difference between a bookkeeper and an accountant?

Accounting is a subjective look at what that data implies for your firm, whereas bookkeeping is a direct record of all transactions and sales that your business makes. A bookkeeper can be considered an accountant, but a bookkeeper without sufficient certification cannot be termed an accountant.

Bookkeeping is a transactional and administrative position that records financial transactions such as purchases, receipts, sales, and payments on a daily basis. Accounting is more subjective, delivering financial insights to business owners based on facts from their bookkeeping.

What is the best way to keep my records in order?

When your accountant or the ATO reminds you to gather all of your records, you know tax season is approaching. You may have everything you need if you’ve been on your game all year, but more often than not, you’ll have a mountain of documentation, some of it important, some of it not. You’ll suddenly recall the items you bought but forgot about because the receipt was misplaced or thrown away. It’s tempting to throw in the towel and any potential deductions with it. You are not alone if this scenario sounds similar. Most people and small enterprises in Australia are in the same boat when it comes to keeping records.

Keeping your tax records organised can help you receive better returns. Aside from refunds, the ATO is tightening down on shady deductions, so you’ll need to be able to show it if you want to claim it. Here are some pointers to help you get rid of the shoebox and organise your records: Keeping track of things, putting together a system, and becoming digital.

Do I pay GST in invoices?

If your company is GST-registered, the invoice must include the GST amount for each specific item (product or service) that you’re billing, as well as some other information about each item. A ‘tax invoice’ is what this is called.

What are the requirements for me to do my own payroll?

Have each employee fill out a W-4 form. Employer Identification Numbers can be found or registered for. Select a paycheck schedule. Select a paycheck schedule. Pay your employees’ payroll taxes. Fill out tax forms and W-2s for employees. This is not a full list of your employment duties. Check federal and state requirements or get professional guidance for advice unique to your business.

What items are tax-deductible?

The majority of tax deductions are for business expenses. Insurance, tax agency costs, charitable donations, and rental property charges are all possible deductions. These expenses are claimed during tax season, and the deductions are deducted from your taxable income. As a result, the amount of tax you must pay is reduced.

Is my car a business expense?

You can claim your automobile expenses as a tax deduction if they are directly tied to your job. To be eligible for a claim, your vehicle or travel expenses must be directly related to your job, according to the Australian Taxation Office (ATO). If you travel for both personal and professional reasons, you can only claim the latter.