Top 25 Cheap Individual Tax Returns Online Australia

Do you require an individual tax return but cannot afford to hire a professional? You’re not by yourself. Tax returns are inconvenient, especially when they are so costly. But, there’s some great news for you! Your tax return does not have to cost an arm and a leg to complete.

We provide the cheapest individual tax returns online in Australia and the finest service. We deal directly with the ATO, so you can be assured that you will not be provided erroneous information or lose out on any money owed to you.

Tax season is here, and if you’ve been putting off filing your individual income tax return, there are several websites that might assist you. The internet provides several choices for submitting your taxes fast and simply, from speedy e-filing to free federal filing support sites. And there’s more. Many places offer price reductions if you file electronically!

Australia’s Comprehensive List Of The Best Affordable Individual Tax Returns

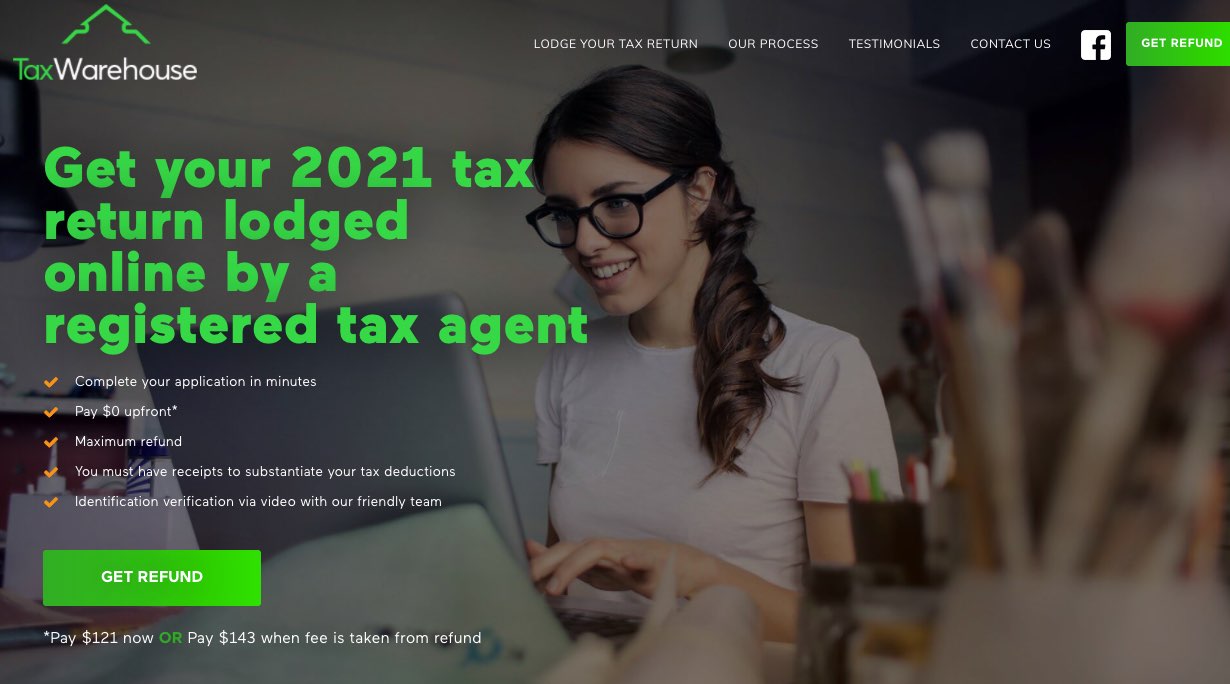

Individual Tax Returns Online Australia – Tax Warehouse

0407 418 209

Save Valuable Time And Money

You may file your tax return online at any time, from the convenience of your own home. We take pleasure in being open and honest, so you can be confident that there will be no hidden prices or fees.

You Can Trust Online Tax Accountants In Australia

Do you hate filing your taxes year after year? Then, you don’t have to anymore! We make submitting your tax return easier than ever at Tax Warehouse because we do it for you!

Our service is quick and easy to use, allowing you to choose a professional tax agent online and get your tax refund filled and processed as soon as possible, all while using your smartphone.

The tax experts at Tax Warehouse will prepare and electronically file your tax return for you.

Their track record of successfully claiming the highest possible deductions and securing the best tax refund possible in your industry. We ensure that only properly certified and accredited tax agents are processing your return in order to provide you the peace of mind that you deserve. Because of our ability to maximise your return amounts while reducing the effort required on your part, you won’t have to dread tax season and will be able to put the money you get back from your taxes to use much sooner.

Happy Tax Australia

07 4755 1111

You pay income tax on assessable income, such as salaries and wages, most Centrelink payments, rental income, bank interest or dividends, company revenue, and capital gains from the sale of assets like as stocks or real estate.

Employment Income

Unless explicitly exempted, all employment-related income, allowances, payments, and other perks must be stated on your tax return.

Salaries and Wages

Salaries and wages (the most common kinds of employment income) are payments paid as recompense for services under an employment contract.

Allowances and Other Employment Income

Other sorts of job income, such as vehicle allowances and gratuities, must be reported.

Lump-Sum Payments

You may get lump-sum payments for unused annual and long service leave when you leave a job, which may be taxed at a lower rate.

Fringe Benefits and Super Contributions Are Both Reportable

Other employment-related expenses, such as reportable fringe benefits and reportable super contributions, must also be included on your tax return.

Q Tax Individual Tax Returns Online Australia

1300 047 829

About Us

QTax has been completing tax returns in Queensland since 1978. Over 500,000 tax returns have been prepared in the previous 15 years, with over 40,000 yearly clients and 100+ Tax Consultants working with us in 30+ locations throughout Tax Season (1st July – 31st October). We take pleasure in the quality of our work and serve individuals, partnerships, organizations, trusts, super funds, and part-time and casual employees at school or university.

We have over 30 seasonal venues, and 13 permanent locations open all year from South East Queensland to Mackay.

So, what are you waiting for? Right now, make QTax your tax preparer!

QTax makes the tax procedure easier.

Why should QTax be your tax advisor?

Unlike many others who are only available during tax season, we at QTax are open all year and can help you.

Pay Nothing Right Now – You may get your tax return completed today and not pay anything until you receive your REFUND. The little extra charge covers all handling, bank, and administrative fees.

Do you know which goods are depreciable and which aren’t when it comes to rental property returns? Then, we can simplify the process of filing taxes and ensure that you get the most out of your rental property.

We Know What You Want – QTAX is the brand you’re familiar with. Since 1978, we’ve been working on and near the Peninsula. We’re still here because we pay attention to the smallest details and give it our all.

Do you require an ABN or GST registration? Do you require assistance with your BAS? We can help you complete out all of the required registration papers and prepare your business activity statements. Does your BAS match the financials on your tax return at the end of the year? If not, let our team handle the reporting obligations for you. We will also lodge your tax return for free if you have QTAX compile your BAS.

Self-Managed Superannuation Funds (SMSF) – Let us simplify the paperwork for you!

Preparation of Tax Returns for:

- Individuals (Salary and Wages, Rental properties, Shares, Capital Gains)

- Companies

- Partnerships

- Trusts

- Self-Managed Super Funds (SMSF)

Preparation of Business Activity Statement (BAS) for:

- Individuals with an ABN

- Companies

- Partnerships

- Trusts

Bookkeeping for:

- Individuals

- Companies

- Partnerships

- Trusts

- Self-Managed Super Funds (SMSF)

Setup and Formation for:

- Companies

- Partnerships

- Trusts

- Self-Managed Super Funds (SMSF)

- ABN (ABN)

- GST (GST)

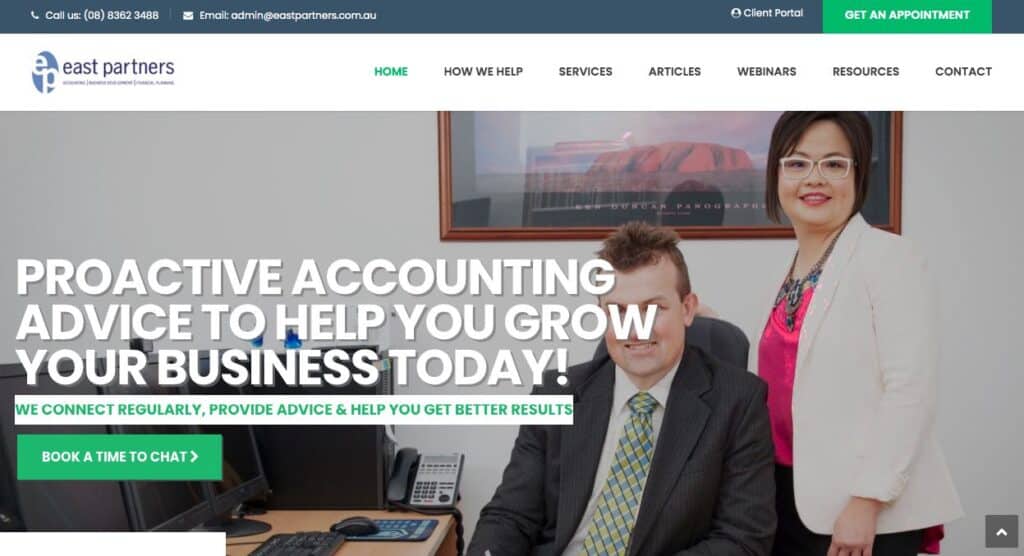

East Partners Individual Tax Returns Online Australia

(08) 8362 3488

We’re Not Merely Business Accountants.

We’ve come to make a significant impact in the lives of our customers. Part of it is providing a high-quality, efficient compliance service. The next logical step is to assist our clients in developing, improving, and expanding their businesses. Our Business Development services are significant and practical services that provide clients with long-term value.

How East Partners Help With Your Accounting

Traditional accounting and tax services, in our opinion, are a crucial element of corporate life that requires special attention and respect.

The majority of accountants are fairly adept at double-checking your information and then entering the correct amount into the appropriate box so that the Tax Man doesn’t show up at your house.

We are different

We reveal the tale that the data are telling and explain it in simple terms so you can grasp it. We make sure that all of the required regulatory reporting is performed, but we also go deeper into the figures and what they indicate for your company’s health.

How We Help You To Grow Your Business

Business may be difficult, especially when you feel like you’re on your own. Our business advice services are meant to guarantee that you are not alone in your company life’s ups and downs.

We can help you unpack your company’s mission and make sure it’s in line with your own goals. This is the most important aspect of our advice process.

Our accounting and financial services are specifically customized to your needs. It might be as easy as a weekly phone call to assess business performance or dedicate a day to envisioning your company’s future and mapping out the steps to get there.

We work with some fantastic people and have built a network of highly qualified specialists. This means that all of your questions and concerns will be answered, and you will receive the greatest advice and service available.

Getting the Basics Right

You have more important things to accomplish than deal with taxes and paperwork. As a result, we carefully manage each stage to reduce your stress. We walk you through every stage of the process, from data collection to form preparation and deadline management throughout the year, so you don’t have to.

- At the beginning of each year, we will advise you of your specific obligations and responsibilities.

- You will be given a set cost so that you are not left wondering about the size of your account.

- The best part is that you get endless FREE help.

Planning your Future

What are your plans for tomorrow? Are you planning to retire? Will you sell your company or operate it at a reduced capacity?

Thinking about the future brings up many concerns and a lot of anxiety.

We can transform this into a well-thought-out strategy, a clear vision of your future that can be implemented and realized. But, let’s face it, if you don’t have a plan and another thing goes wrong, your future won’t be what you hoped for.

Managing Your Wealth

You work quite hard. Your efforts may be paying off in the form of savings, or you may already have a portfolio. In any case, you want to be sure that your hard-earned money is invested wisely, secured, and properly handled.

Mulcahy & Co. Individual Tax Returns Online Australia

1300 204 781

Full-service financial solutions help individuals, businesses, and farms alike.

We’re here to help you achieve financial stability.

Mulcahy & Co is a one-stop-shop for all things accounting, taxation, financial planning, legal, loans and finance, and marketing.

We’ve been providing specialized personal services to businesses, farmers, people, and retirees for more than two decades.

Accountants, tax professionals, and business counsellors on the Sunshine Coast are ready to help you achieve financial security.

Our team of certified accountants and tax professionals can assist you in making the best financial decisions and achieving financial stability.

Accounting and taxation are more than just compliance. Mulcahy & Co offers accounting, taxation, advice, and assistance to help you get the most bang for your dollars.

“Are you financially secure?” our accountants ask each customer initially. Our objective is for our clients to understand what it takes to achieve and maintain financial security.

Mulcahy & Co is a Sunshine Coast accounting business that specializes in cloud accounting and is a partner of Xero, a major cloud accounting software provider that we also use for bookkeeping.

Our accountants are experienced and competent business strategists. We offer full company planning services, including expert advice and help in the areas of business development, health checks, succession planning, startup, and strategic planning.

Mulcahy & Co Sunshine Coast’s services also include tax and accounting assistance for individuals. Our tax accountants are among the best in the business, and we also help customers with government services such as youth allowances and pensions. Do you need help completing your ATO tax return? Please contact us soon away.

SMSF (Self-managed super fund) compliance and support and succession planning are among our accounting and tax accounting services.

Check out some of our services below, and then contact us for additional details or to speak with one of our tax accountants.

Accounting Services

Bookkeeping

Cloud accounting software has revolutionized bookkeeping, putting an end to arduous manual data input days.

Business Planning

In today’s climate, we recognize that company owners confront several hurdles. We can handle all parts of company planning.

Cloud Accounting

There are several advantages to using cloud accounting software. First, everything is covered, from data backup and redundancy to accessing your finances from anywhere.

Individual Tax Returns

Individuals can use a comprehensive financial services package to assist them in reaching their financial objectives.

SMSF Compliance

Self-managed super funds are most advantageous when they are completely compliant with changing tax and superannuation legislation.

Succession Planning

Because all business owners will eventually retire, succession planning is critical for the long-term viability of private businesses and farming operations.

Taxation

Our tax accountants are professionals in all things tax and take pleasure in the high quality of tax services they deliver.

Government Services

It might be challenging to find your way through government services. We can assist you.

Business Valuations

Business appraisals may be quite beneficial. For example, when you’re refinancing, writing a business plan, or planning to sell or leave your company, a valuation is a key step that allows you to go forward with confidence.

Maurer Taxation Individual Tax Returns Online Australia

0438 960 990

All of your individual and business tax requirements are met.

5+ Years Experience

We handle taxes, so you don’t have to. Individual tax returns, sole trader tax returns, business, partnership, and trust tax returns, as well as consultations and ATO representation, are all services we provide.

Get The Maximum You’re Entitled To

Our tax accountant has extensive knowledge in a variety of jobs and sectors, so he or she knows exactly what you may claim to achieve the best possible outcome at a reasonable cost.

We Do Everything

We are a locally owned and operated family business that is here to assist you and your company. Our tax accountant specializes in rental investment, international taxes (for expats), bitcoin, stocks/managed funds, capital gains tax, small company, and personal services income (PSI).

Tax Returns

- A courteous and helpful tax professional swiftly prepares and files tax returns.

- Your tax refund will arrive sooner if you file on the same day.

- Returns for individuals, ABNs, partnerships, corporations, and trusts are all accessible.

Taxation Advice And Planning

- Sessions of consultation and guidance to address any of your tax concerns.

- ABN registration, GST registration, and company/partnership/trust formation are all examples of entity creation.

Astro Accountants Individual Tax Returns Online Australia

07 3180 3161

People – Planet – Purpose

Simply said, the people we work with, the environment we create, and the causes we support drive our company. Astro’s staff is committed to helping people improve their money management skills, both in business and as investors. As a consequence, we believe that having a safe financial position encourages you to serve others, pass on your expertise, and live your best life.

Strategic business & Investment advice

If you want to get your finances in order once and for all, you should hire a professional. Your accountant will collaborate with you to analyze your business structure, cash flow, and profit to verify that you are meeting your financial commitments. Deal with a reputable business that provides excellent communication and prompt service.

Tax & advice available online

Taxes are one of your largest outgoings, and missing a deadline may wreak havoc on your finances. Our strategic counsel benefits companies, trusts, SMSFs, and property owners. In addition, we can assist you with reorganizing your affairs to ensure that you satisfy your ATO duties, decrease your risks, and pay the least amount of tax possible. The Australian Taxation Office (ATO) mission is to efficiently administer and shape the tax and superannuation systems to support and fund services for Australians. We administer tax law and essential components of superannuation law in this function and provide recommendations to Treasury to aid in the formulation of tax legislation.

Our staff will keep you informed and on track to meet your deadlines. We also provide programs that save your deductions online and extract the data for simple access when you need it.

- Isn’t it past time for you to become an Astro Accountant?

- We prepare all ATO and ASIC paperwork.

- Reorganization and tax planning.

- Create new businesses and trusts

- Help you comprehend your statistics by providing business counselling and Xero training.

- Examine options for reducing debt and increasing cash flow.

- Notify you of upcoming deadlines.

- Receipt Bank is how we make sure you have all of your receipts.

- We’ll show you how to manage your money more effectively.

- All of our registered clients receive free telephone advice.

Express Tax Back Australia

1800 739 739

The “Tax Back System” has been shown to return more tax and faster!

Our “express tax refund system” is developed for backpackers, travellers, and students to ensure the largest tax refund in the quickest period possible.

We would gladly provide you with a Free Estimate of how much you will get.

It is never too late or too early to claim your Australian tax back, regardless of when or where you worked in Australia. Did you know that you may get a tax refund for any job you had in Australia for the previous 12 years?

There is no upfront cost. Once we’ve received your return, we’ll deduct the little cost.

Free document retrieval service

Don’t be alarmed. Our “document recovery team” will contact your firm and government agencies on your behalf to get the necessary documents. It is an entirely free service.

“No Refund-No Fee” is our policy. As a consequence, if you are not qualified for a tax refund, we do not charge a fee.

To get your refund, you can select from a number of options.

Not happy with your tax refunds?

Our “tax back checker” can help you remedy any errors and collect the return you deserve.

You are no danger because our policy is “no return, no cost.” Therefore, finding out if there is more money is completely free.

Do you intend to return home? Then, get your tax refund right away!

You may collect your tax refund now and have it transferred into your Australian bank account before you leave Australia.

Are you working till the last possible moment? Allow our office to organize the documents before you leave. Then we’ll get the documentation from your boss and set up your tax refund and super refund.

We may then deposit your funds into any bank account in any nation, or we can send you a check.

Not in Australia – no problems!

Our clientele are located all over the world therefore, we focus on them rather than Australia. We also offer the best returns, the simplest documentation, and the most affordable costs. But wait, there’s more!

We have over 21 years of experience and provide a Guaranteed Refund Service. Your tax refunds can be directly deposited into any bank account. You can’t go wrong in any country!

Tax Today Individual Tax Returns Online Australia

1300 829 863

Instant Tax Refunds

How does it work?

Tax Today is the leading supplier of same-day tax refunds in Australia. We are truly leading the way, with over 14 offices across Australia and online tax returns. You may acquire a professionally prepared tax return and have your tax refund sent to you immediately at Tax Today.

This might be in the form of a cashable check or a one-hour direct transfer into your bank account. That is why our name is Tax Today. The majority of refunds are issued at the time your tax return is filed. That’s nearly as quick as a cash machine.

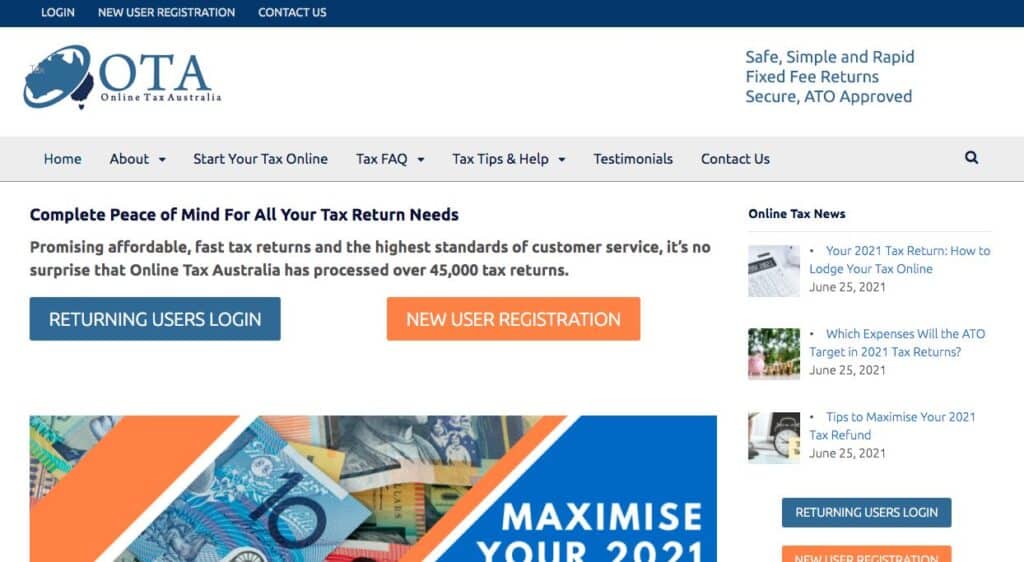

Online Tax Australia

(03) 9852 9051

Three brothers own Online Tax Australia, a family-owned business (Brendan, Michael and Stephen).

Our staff has received extensive training and is well-versed in the standards that must be met when submitting a tax return via an online service. In addition, each of us has over 20 years of experience in the areas of accounting, taxes, as well as the development and management of businesses.

Before we formally submit a tax return to the ATO, we have each and every one that is sent to us double-checked by an experienced tax agent. This ensures that any concerns or items that require clarification are handled before the return is filed.

It should come as no surprise that Online Tax Australia has finished more than 45,000 tax returns after making claims that their services are low cost, quick, and adhere to the highest standards of customer care.

How Online Tax Australia Works

Our online tax return service is simple and straightforward, with only three basic steps:

- First, answer a series of straightforward yes/no questions.

- Fill out our simple worksheets with your Sende ready, send your return to our certified, experienced tax professionals for evaluati when you’re readyon and filing.

Trial Access is Free: There is no cost if you complete a return but decide not to submit it to us for review and filing.

There is no need that you must complete your tax return in a single sitting. If you have any questions or need any additional information, all you have to do is pick the option that says “Save and Log Out.” You will have the opportunity to revise your return at a later time. This affords you the chance to get in touch with us prior to the completion of your tax return should there be any problems or information that is lacking.

Our tax agents will conduct a thorough evaluation of your return after it has been submitted to us. We’ll contact you personally if we have any queries or need to clarify anything. Rest assured that our review service comes at no additional cost. Last but not least, we file your tax return with the Australian Taxation Office (ATO).

Our customer care representatives are accessible all year to help you with any queries or ATO-related difficulties. With OTA, you may have year-round peace of mind.

Our Services & Pricing

Since 2018, the Australian Taxation Office (ATO) has implemented a number of important changes to the review process that each and every tax return is subjected to. As a result of these developments, the onus of responsibility for filing accurate tax returns now falls squarely on the shoulders of the individual taxpayer. The all-inclusive nature of OTA’s services ensures that you will have everything at your disposal to compile and submit an appropriate tax return. Our experts will log into the ATO website on your behalf to confirm the accuracy of all of the data that is readily available, such as interest income, dividends, and government payments. In addition, before submitting your tax return to the ATO, we double-check all of your tax deductions to ensure that they are accurate and in accordance with the relevant tax legislation (if necessary). Your potential for ATO changes, fines, and interest will be considerably reduced by utilising our strategy.

Our Premium Pre-Fill Service: Making Tax Even Easier

For an additional $10, you may use Online Tax Australia’s Premium Pre-Fill Service to make the tax return procedure more easier and faster. Online Tax Australia will undertake the laborious job of locating and entering all required information available through the myGov site with the aid of our Premium service. PAYGs, interest, dividends, Centrelink information, HECS/HELP, and more are all included. All you have to do now is fill in your personal information and tax deductions. As a result, when you use our Premium Pre-Fill Service, we make the already straightforward process of filing your tax return even easier and less stressful.

Great Arguments for Choosing Us

- An experienced, professional tax agent examines every return.

- Professional, experienced, qualified, and open accountants are available to answer any of your queries.

- Exclusive to OTA software that is convenient, quick, and simple to use. You may finish your tax returns in 15 minutes from your home or office convenience.

- Fee is affordable and set (which is completely tax-deductible).

- Tax refunds are processed within 10 to 14 days (subject to ATO processing).

- A safe, secure, and ATO-approved website that ran well.

- Try it for free. There’s no obligation. There is no cost if you complete a return, but do not submit it for inspection and lodgement.

- OTA does not charge interest, late payment penalty, or subscriptions.

New Wave Individual Tax Returns Online Australia

(07) 55041999

Your Trusted Gold Coast Accountants.

We assist businesses in reducing taxes and increasing profits!

We’re not your run-of-the-mill accounting firm. Over 800 Gold Coast entrepreneurs and company owners have used our outside-the-box accounting, advisory, and bookkeeping services to establish, develop, and expand their businesses.

How much does your Accountant & Bookkeeper cost Your Business?

Think about where your business would be if it avoided an additional $10,000, $20,000, $50,000, or even $100,000 in annual taxes. You have the option of investing this money in marketing, recruiting new staff, or simply raising your personal bonus for all of the hard work that you have done over the years. In terms of your company’s financial stability, not only would you be able to lift a significant burden off your shoulders, but you would also have the distinct impression that things were finally beginning to move in the right direction.

Consider whether you are:

- Are you sick of the fact that the ATO receives all of the money you earn despite your best efforts? (Yes, we do think that everyone should pay their fair share of taxes; however, we do not think that anyone should pay more than they absolutely have to.)

- Are you sick and tired of being in the dark about the current state of your company, the amount of back taxes you owe, and whether or not you even make a profit?

- Are you fed up with your typical DINOSAUR accountant that only communicates with you once a year and provides you with no valuable advice?

With our ‘outside the box’ solutions, our team of Chartered Accountants and Firm Advisors will assist you avoid the stress and worry of attempting to estimate the financial status of your business.

- When we investigated a Labor Hire company’s last two years of tax forms, we discovered that they had overpaid $200,000+ in taxes.

- When a construction company sold their firm, they saved almost $88,000 in taxes;

- Enabling an electrical provider to reduce their monthly rent expenses by purchasing commercial property through their pension plan;

- Achieved a year-over-year increase in beauty store revenue of between 100 and 150 percent;

- Enabling a rapidly growing online store to accurately anticipate its cash flow and make the necessary decisions before it was too late.

These satisfied patrons are just a few of many others who have purchased from us. If you were to become one of them, we would love to help you along the way. What does your current accountant charge you? If the response is “cheap,” then I can nearly ensure that they are not investing the time or effort necessary to assist you in achieving these kinds of results. If they do, however, respond with “free,” then I can almost guarantee that they are. It’s possible that you’re passing up thousands of dollars in opportunities.

One-Stop Tax Australia

(02) 8373 5917

Have your tax return prepared online by a trained CPA tax accountant.

This is neither a self-service or automated internet tax return system. We take care of everything for you! All returns are prepared EXCLUSIVELY by a trained CPA Tax Accountant at One-Stop Tax to guarantee you receive the greatest refund possible. Simply complete our online tax return questionnaire with our help and attach your tax papers. The rest will be taken care of by us.

Tax Ware House Individual Tax Returns Online Australia

407418209

The Online Tax Accountants You Can Trust in Australia

Do you hate filing your taxes year after year? You don’t have to anymore! We make submitting your tax return easier than ever before at Tax Warehouse, and we do it for you!

Our service is quick and easy to use, allowing you to locate a competent tax agent online and get your tax return filled and processed as soon as possible, all while using your smartphone.

Tax Warehouse’s tax professionals will file your tax return for you online.

Their track record of claiming the greatest deductions and obtaining the largest tax refund feasible in your sector. We provide you peace of mind by ensuring that your return is handled by properly certified and licensed tax agents. We maximize your refund amounts while minimizing your effort, so you don’t have to dread tax season and can put your tax refund money to work sooner!

What can you anticipate from our online tax agent services?

No matter who you are or what industry you work in, the online tax help that we provide is individualised to fit your specific circumstances. We provide our services to individuals and businesses in the building and trades industries, as well as those working in business and the creative industries, retail workers, agricultural labourers, school instructors, office workers, social workers, and anyone else who is required to file an Australian tax return. Therefore, if you live in Adelaide, Mildura, Melbourne, Sydney, Brisbane, Perth, Darwin, Gold Coast, Cairns, Townsville, Hobart, Shepparton, Swan Hill, Portland, Sale, Toowoomba, Broome, or any other city or town in Australia, our online tax accountants can ensure that you get the most out of your return in a matter of minutes. They can do this no matter where you are in Australia. In addition, the Tax Warehouse is aware of all the tax deductions for which you qualify. Because of this, you may rest assured that you will get a hefty tax refund each year.

Taxopia Individual Tax Returns Online Australia

1300 829 674

Professional Accountants and Registered Tax Agents

The Taxopia team has over 40 years of expertise in professional corporate accounting and consultancy services. We’re a forward-thinking accounting business with full public practice certification, registered tax agents, and ASIC agents on staff. We’ve written tax and business articles for publications including the Australian Financial Review, BRW, and the Flying Solo Small Business Forum in the past. We have received thousands of business tax reports, business activity statements, company tax returns, and trust tax returns. Our products are of the best quality and provide exceptional value to small and microbusinesses in Australia.

Serving All of Australia from its base in Melbourne

Taxopia is a modern online accounting service based in Mount Waverley, Melbourne. We employ cutting-edge technology to keep your sensitive company or trust tax information secure and private. It makes no difference if your company is headquartered in Brisbane, Sydney, Perth, Adelaide, Melbourne, or anywhere in between. Taxopia provides excellent tax accountant services in all parts of Australia.

Low Prices, Excellent Service

Taxopia provides professional and affordable online tax returns and accounting services at a fraction of the cost of other corporate accounting organizations. Taxopia keeps expenses low by ensuring that the most up-to-date technology and practices are used to expedite the tax return processing. Furthermore, all documentation and communication are created and signed electronically, which allows us to provide low-cost online tax returns.

Are you searching for cheap individual tax returns online?

Taxopia can help you with your taxes! Taxopia is situated in Melbourne and is owned by Australians. We employ cutting-edge technology to keep your sensitive company or trust tax information secure Our prices, our service is of the hi despite our low pricesghest quality, and our tax accountants are professionals!

Individual yearly tax returns are available at Taxopia. We can also give quarterly BAS solutions if you choose. In addition, because of our significant experience, we can provide more sophisticated tax assistance if necessary.

Do you have any old tax returns that need to be filed? They can also be accommodated in Taxopia.

Frequently Asked Questions About Individual Tax Return

What is an individual tax return?

Individual tax returns are official forms that a single person or a married couple files with a federal, state, or municipal taxation body to record all taxable income earned within a certain time period, generally the preceding year. These returns can be filed by either the individual or the married couple. These numbers are input into a formula that determines the amount of back taxes that must be paid as well as the amount of tax that has been overpaid for the relevant time period.

Who is eligible for a tax return?

You need to file a return if you’re a: Single dependent under age 65, not blind, and any of these apply: Your unearned income was more than $1,100. Your earned income was more than $12,400.

Who needs to complete a tax return in Australia?

If any of the following apply to you, you are required to submit an income tax return. For instance, tax was deducted from any payments (like salaries) given to you during the tax year and remitted to the appropriate agency. if you reside in Australia and your taxable income was greater than the tax-free threshold of $18,200, then you will be required to pay tax.